A new roof system’s impact on homeowner’s insurance premiums is a direct calculation of reduced risk, where the installation of modern, code-compliant materials and construction techniques verifiably lowers an insurance carrier’s potential liability from wind, water, and impact events. A roof is the top covering of a building, engineered to provide protection against environmental forces; its condition is therefore a primary variable in actuarial assessments of property risk. A degraded or obsolete roof represents a significant, quantifiable liability. A new, properly documented roof system represents a mitigated liability, which often translates to a reduction in policy premiums.

This is not a negotiation or a subjective assessment. It is a financial transaction based on verifiable data. For meticulous homeowners who view their property as a significant asset, understanding this transaction is critical. If your primary goal is to secure the lowest possible price for a roof replacement, we are not the right fit for you. Our process is engineered for homeowners who demand predictability, transparent documentation, and a final product that maximizes long-term value, including its favorable standing with insurance carriers. The alternative is the chaos of the standard roofing industry—a path that often leads to installation defects, failed inspections, and an inability to secure the insurance discounts you are entitled to.

The Financial Rationale: How a New Roof System Reduces Insurer Risk

An insurance policy is a contract based on the mathematical probability of future loss. Insurers view an old, compromised roof as a high-probability event for a future claim. Its structural system, materials, and connection points are liabilities. A new roof, installed to current building codes, systematically eliminates these liabilities. It is an engineered solution that directly addresses the primary perils that concern an underwriter: wind, water, and impact.

Mitigating Wind Uplift: The Primary Insurance Concern

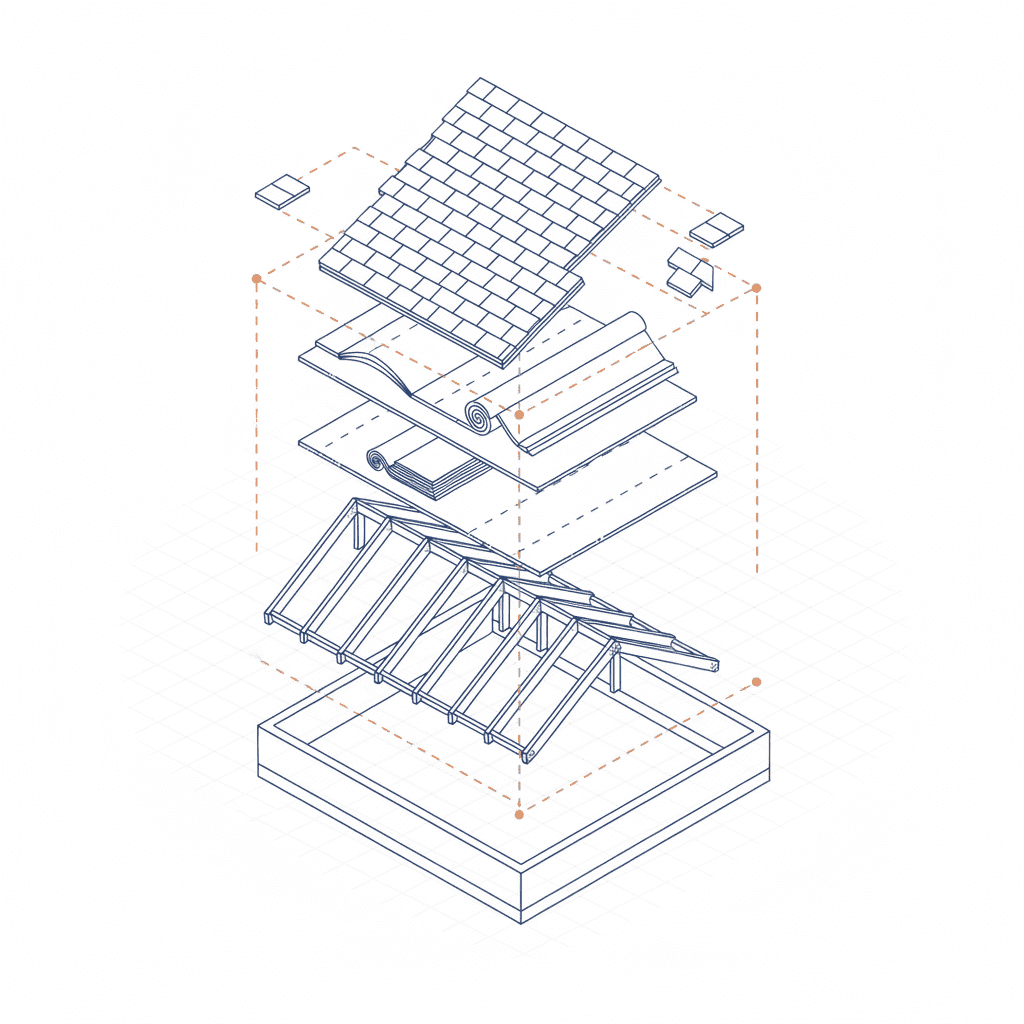

Wind uplift is the force generated by wind flowing over and under a roof, creating a pressure differential that can lift and detach shingles, sheathing, and even the entire roof structure. A new roof mitigates this risk through a system of specific, code-mandated components. The roof’s function of providing protection against wind is paramount. Modern building codes require a specific fastener schedule for roof sheathing and covering, ensuring the nails or screws are spaced correctly to achieve a designated wind resistance rating. This systematic approach transforms the roof from a potential failure point into a cohesive, resilient structure that performs predictably under stress. This predictability is precisely what an insurer values and rewards.

Preventing Water Intrusion: A Non-Negotiable Performance Metric

Water intrusion is the second major source of high-cost insurance claims. An aging roof with degraded underlayment and failing flashing is an open invitation for a roof leak. A modern roof system provides protection against rain and snow through a multi-layered barrier. This consists of a primary roof covering and, crucially, a secondary water-resistant layer like a self-adhering ice and water shield or a high-performance synthetic underlayment. Properly installed flashing around penetrations (vents, chimneys) and in valleys creates a seamless defense. This system is designed to prevent water intrusion even if the primary covering is damaged, a level of risk mitigation that directly reduces an insurer’s exposure to costly interior damage claims.

Impact Resistance Ratings: Quantifying Protection from Hail and Debris

Hail damage is a frequent and expensive peril in many regions. Insurers quantify a roof’s ability to withstand it using the UL 2218 impact resistance test. This test classifies roofing materials from Class 1 to Class 4, with Class 4 offering the highest level of protection. A Class 4 shingle, for example, is engineered to withstand the impact of a 2-inch steel ball dropped from 20 feet without splitting or cracking. By installing a roof covering with a certified impact resistance rating, you are providing the insurer with objective, third-party data that proves a lower probability of hail-related claims. This verifiable reduction in risk is often rewarded with the most significant premium discounts.

| Class Rating | Test Standard (Steel Ball Diameter) | Insurance Discount Potential |

|---|---|---|

| Class 1 | 1.25 inches | Minimal to None |

| Class 2 | 1.50 inches | Low |

| Class 3 | 1.75 inches | Moderate |

| Class 4 | 2.00 inches | Highest |

Qualifying for Discounts: A System-Based Verification Process

Securing an insurance discount is not automatic. It requires the policyholder to provide the insurance carrier with clear, indisputable evidence that the new roof system meets specific criteria for risk mitigation. This is a documentation-driven process that leaves no room for ambiguity. A contractor who does not understand or manage this process introduces chaos and jeopardizes your financial benefit. Our process is designed to eliminate that chaos by delivering a complete, verified documentation package.

Essential Documentation: The Roof Replacement Contract and Invoice

The foundational documents are the executed roofing contract and the final, paid-in-full invoice. These legal records serve as proof of replacement. They must clearly state the licensed contractor’s information, the property address, the total cost, and the exact installation date. Most importantly, the scope of work must detail the specific materials used, including manufacturer and product names for shingles, underlayment, and other key components. This provides the insurer with a clear record of the new asset that has been installed on the property.

Photographic Evidence: Documenting a Code-Compliant Installation

Words are not enough. Photographic documentation of the installation process is a non-negotiable component of verification. For the meticulous homeowner, this is assurance against shortcuts. For the insurer, it is visual proof of compliance. We systematically document critical checkpoints of the installation, including the condition of the roof sheathing, the specific nail pattern used, the proper installation of drip edge and starter strips, and the layering of underlayment and flashing. This photo log serves as an as-built record, demonstrating that the roof was constructed not just with the right materials, but with the correct, code-compliant methodology.

The Wind Mitigation Inspection Report: Third-Party Verification

The most powerful tool for securing discounts, particularly in coastal states, is a certified Wind Mitigation Inspection Report (such as Florida’s OIR-B1-1802 form). A licensed inspector completes this standardized form after the roof is finished. They independently verify key attributes of the roof’s construction that contribute to wind resistance. This includes the roof geometry (hip vs. gable), the method of roof-to-wall connection (e.g., hurricane clips), the presence of a secondary water resistance (SWR) barrier, and the nailing pattern of the roof deck. A favorable report from a third-party inspector is the ultimate validation for an insurer, providing them with the exact data needed to apply the maximum available credits to your policy.

Material Selection and Its Direct Impact on Premium Reductions

The materials specified in your roofing contract are line items in an insurer’s discount calculation. Selecting a material with a certified performance rating, such as a Class A fire rating or a Class 4 impact rating, provides a direct pathway to premium reductions. The choice of materials for the top covering of your building is a financial decision as much as an aesthetic one.

Class 4 Impact-Resistant Shingles: The Gold Standard for Credits

Class 4 impact-resistant asphalt shingles represent the pinnacle of residential roofing technology for mitigating hail risk. These shingles are manufactured with a polymer-modified bitumen (asphalt), which creates a rubber-like flexibility. This allows the shingle to absorb the energy of a hailstone impact without fracturing or losing its protective granules. Insurers in hail-prone regions heavily favor these products and offer substantial premium credits because they drastically reduce the likelihood of a widespread, event-driven claims scenario. The upfront investment in a Class 4 shingle is offset by the long-term premium savings and the reduced likelihood of a premature replacement.

Metal Roofing Systems: Analyzing Longevity and Durability Discounts

A standing seam metal roof is an engineered system valued by insurers for its exceptional durability, longevity, and resistance to severe weather. Metal roofs typically carry a high wind speed rating, often exceeding 140 mph, and are inherently fire-resistant (Class A). Their interlocking uprights and concealed fastener systems create a monolithic surface that is highly resistant to wind uplift and water intrusion. While the initial cost is higher than asphalt shingles, insurers recognize the asset’s extended lifespan and superior protective qualities, often rewarding a properly installed metal roof with significant, long-term policy discounts.

Secondary Water Resistance (SWR): The Underlayment Mandate

The layer beneath your shingles, the underlayment, is a critical component for insurance discounts. The old standard, roofing felt, offers minimal protection once the primary roof covering is breached. The modern standard, which qualifies for the SWR credit on a wind mitigation report, is a sealed roof deck. This is achieved by using a self-adhering ‘peel-and-stick’ underlayment that seals directly to the wood sheathing and around every nail penetration. This creates a continuous, waterproof barrier that protects the home’s interior even if shingles are blown off in a high-wind event. For an insurer, this is a game-changer. It contains the damage to the roof covering itself, preventing a catastrophic water intrusion claim. Mandating and documenting this layer is a core part of our process.

A Predictable Process for Securing Your Insurance Discount

The goal is a predictable outcome. You invest in a high-performance roof system, and in return, you receive enhanced protection and a lower insurance premium. This outcome is only possible through a meticulously managed process that eliminates the variables and chaos common in the construction industry. Our entire operation is built to deliver this predictability.

We Are Not for Bargain Hunters; We Are for Meticulous Planners

Let us be clear. If your selection criteria for a roofing contractor is based primarily on finding the lowest price, we are not the company for you. Our clients are meticulous planners who understand that a roof is an engineered solution, not a commodity. They are making a long-term investment in asset protection and seek to avoid the hidden costs of poor workmanship, project delays, and failed inspections. Our higher standard is not for everyone. It is for homeowners who value a zero-defects approach and the peace of mind that comes from a process executed with precision.

Our Role: Providing Turnkey Documentation for Your Insurer

Our work does not end when the last shingle is installed. We consider the delivery of a comprehensive documentation package to be a final, critical phase of the project. We act as your administrative liaison, assembling and providing all necessary paperwork for your insurance carrier. This package includes the final contract, paid invoice, material specification sheets, warranty information, our complete photographic installation log, and coordination with your chosen wind mitigation inspector. We remove the burden from you and ensure your insurer has everything they need to process your well-deserved discount.

The Antidote to Chaos: Your Dedicated Project Manager

The typical roofing project is a source of anxiety for homeowners due to poor communication, vague timelines, and a lack of a single point of responsibility. We eliminate this chaos with one simple, powerful solution: a dedicated Project Manager. This individual is your single point of contact from start to finish. They manage the timeline, coordinate the crew, answer your questions, and provide frequent, clear updates. There are no surprise charges. There are no unanswered calls. This is the only sane way to manage a complex construction project on your most valuable asset. This is our process.

We define the exact materials and methods required to meet code and qualify for insurance credits. No ambiguity.

Your dedicated Project Manager oversees a documented, code-compliant installation, providing you with daily updates.

We coordinate the wind mitigation inspection to provide objective, third-party verification of our work.

We deliver a complete documentation package to you and your insurance agent for premium reduction processing.