Actual Cash Value (ACV) and Replacement Cost Value (RCV) are the two primary valuation methods insurance carriers use to calculate the payout for a damaged roof—the top covering of a building responsible for protection against rain, snow, sunlight, and wind. Understanding this distinction is not a matter of trivial insurance jargon; it is the fundamental variable that determines your out-of-pocket expense. A misunderstanding here is the primary source of financial stress and chaos in the claims process. Our methodology is built to eliminate that chaos through absolute clarity.

This is not a guide for finding the cheapest path. If your primary goal is to secure the lowest bid, we are not the right partner for your project. Our process is designed for meticulous homeowners who value predictability and want to ensure their property’s structural integrity is restored correctly, with a transparent financial plan. For these clients, we offer the only sane way to manage a roofing claim.

Foundational Definitions: Decoding ACV and RCV in Your Policy

Your insurance policy is a financial contract. Its terms dictate the resources available to restore your building’s primary protective barrier. ACV and RCV are the core clauses that define the financial limits of that restoration. They are not interchangeable.

Replacement Cost Value (RCV): The Full Cost to Restore Your Roof’s Protection

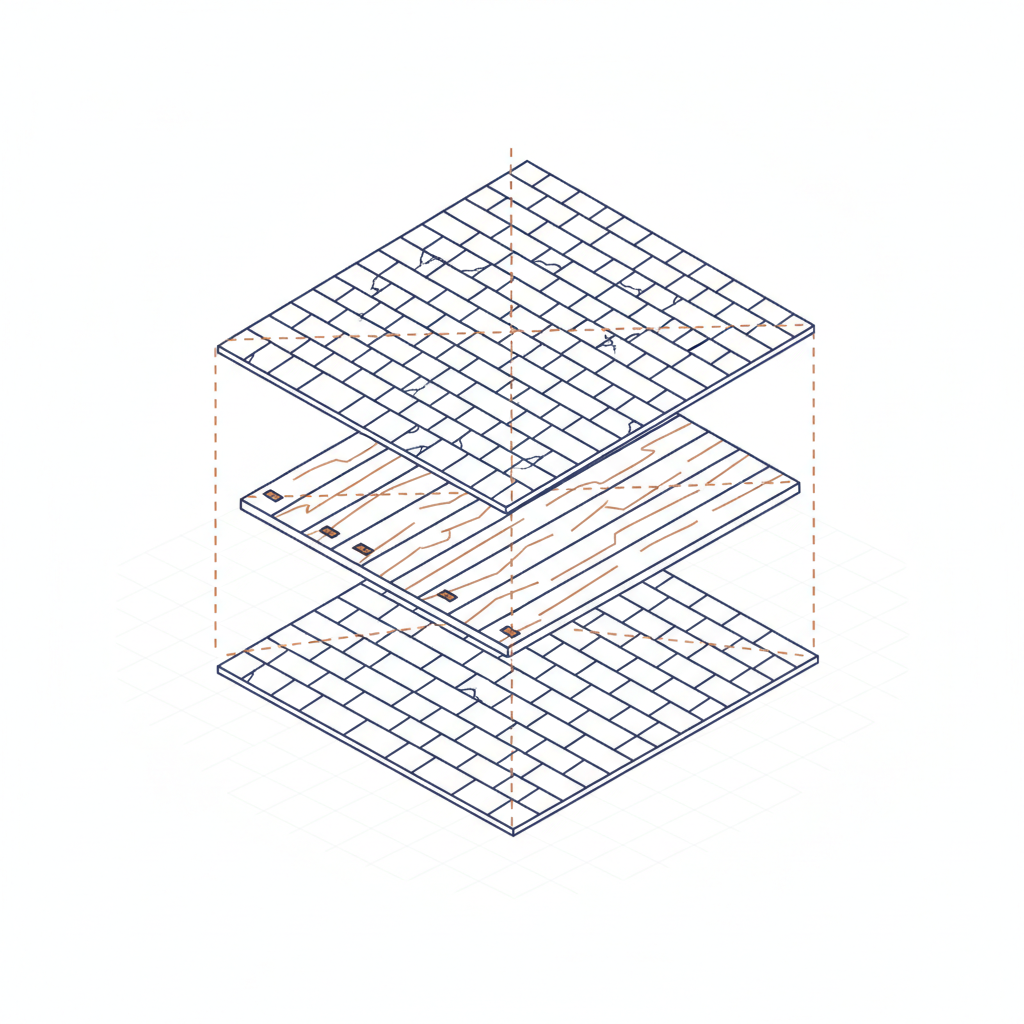

Replacement Cost Value (RCV) refers to the full, current-day cost required to replace or repair your damaged roof with materials of a similar kind and quality, without any deduction for depreciation. This coverage is designed to restore your roof to a new condition, ensuring its capacity to provide complete protection against weather is fully reinstated. RCV coverage reflects the reality that you must purchase new materials at today’s prices to execute a proper repair. It is the gold standard for property protection.

Actual Cash Value (ACV): Your Roof’s Value After Factoring in Depreciation

Actual Cash Value (ACV) is the value of your roof at the time of the loss. It is calculated by taking the Replacement Cost Value and subtracting depreciation. Depreciation is the loss in value due to the roof’s age, its condition, and general wear and tear from exposure to the elements. An ACV payout provides funds equal to the remaining useful life of your old roof, not the cost to purchase a new one. It functions as a depreciated reimbursement, leaving you to cover the financial difference.

| Attribute | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Basis | Cost to replace with new, similar materials | Cost to replace, minus depreciation |

| Homeowner’s Expense | Deductible only (typically) | Deductible + Full Depreciation Amount |

| Goal | To make you whole; restore to pre-loss condition | To reimburse for the remaining life of the old asset |

| Ideal For | Protecting asset value and minimizing surprises | Lower premiums, but with significant financial risk |

Recoverable Depreciation: Bridging the Financial Gap Between ACV and RCV

In an RCV policy, the insurance payout is typically delivered in two installments. The first payment is the Actual Cash Value (ACV). The remaining funds, known as Recoverable Depreciation, are held by the insurer. This second, larger payment is released only after the roofing contractor submits a final, itemized invoice proving that the full scope of work has been completed and the total costs have been incurred. This two-step process exists to ensure homeowners use the funds to complete the repairs as intended, rather than pocketing the full RCV payment and performing a cheaper, ACV-level repair. Managing this process requires meticulous documentation and financial transparency from your contractor.

Financial Implications: Mapping Payout Scenarios to Your Building’s Top Covering

The type of policy you hold dictates the financial workflow of your roof replacement. An RCV policy creates a clear, predictable path to full restoration. An ACV policy creates an immediate and often significant budget shortfall. The chaos of a typical roofing project—surprise charges, debates over materials, and vague timelines—stems directly from a failure to map this financial reality from the start.

Executing an RCV Claim: A Step-by-Step Financial Workflow

A properly managed RCV claim is a predictable, transparent process. It is a sequence of logical steps, each with a clear objective. There are no surprises. This is our mandatory workflow for every insurance restoration project.

We conduct a thorough inspection and document all damage, aligning our findings with the insurance adjuster’s report to create a single, undisputed scope of work.

The insurance carrier releases the first check for the Actual Cash Value, which covers the depreciated value of the damaged roof.

We execute the full scope of work using new, high-quality materials to restore the roof’s protective function completely.

We submit a detailed, line-item final invoice to the insurance carrier, providing proof that all work has been completed and costs incurred.

The carrier releases the final payment, covering the depreciation amount and closing the financial gap. Your only cost is the deductible.

The Inevitable Budget Shortfall of an ACV-Only Policy

An ACV-only policy guarantees a budget shortfall. If your roof is 10 years into a 20-year lifespan, its depreciation may be calculated at 50%. The insurance payout will therefore be approximately 50% of the replacement cost, minus your deductible. You are financially responsible for the other 50%. This is not a surprise; it is the mathematical reality of an ACV policy. Homeowners with older roofs or those who purchased a cheaper policy are often forced to choose between a massive out-of-pocket expense or a substandard repair that compromises their home’s protection.

Code Upgrades & Construction Standards: A Common Point of Financial Failure

Another common source of chaos is the cost of building code upgrades. If your roof was installed a decade ago, local building codes governing materials, ventilation, or attachment methods have likely changed. A standard insurance policy often excludes the cost to comply with these new construction standards. This can lead to thousands of dollars in surprise charges. Mitigating this risk requires a specific policy endorsement, often called ‘Ordinance or Law’ coverage. A process-driven contractor will identify these code requirements upfront and ensure they are addressed in the insurance scope of work before the project begins, preventing financial failure at the end.

Claim Valuation: How Your Roof’s Condition Impacts Your Payout

The value of your claim is not arbitrary. It is determined by a systematic, if sometimes contentious, calculation of depreciation. The adjuster’s assessment of your roof’s condition, age, and exposure to weathering directly impacts the amount of depreciation withheld and, consequently, your initial payout.

The Depreciation Formula: Quantifying Exposure to Rain, Wind, and Sunlight

Depreciation is typically calculated with a straightforward formula: `(Total Replacement Cost / Expected Lifespan) x Effective Age = Total Depreciation`. While the replacement cost and lifespan are relatively objective, the ‘Effective Age’ can be subjective. An adjuster determines this based on evidence of weathering. This includes granule loss on shingles from rain and hail, sealant strip failure from UV (sunlight) exposure and extremes of temperature, and uplift damage from wind. A roof that has endured harsh conditions may have a higher effective age than its chronological age, leading to a larger depreciation withholding.

How Proactive Maintenance Reduces Depreciation and Maximizes Value

Deferred maintenance accelerates depreciation. A roof with clogged gutters, accumulated debris, or minor, unaddressed damage will be judged more harshly by an adjuster. Conversely, proactive maintenance demonstrates a commitment to preserving the asset. A clean roof with clear drainage and documented repairs has a lower effective age. This tangible evidence supports a negotiation for less depreciation, maximizing the initial ACV payment and reducing the financial burden during the project. It is a direct strategy for asset longevity and claim value optimization.

A Process-Driven Approach to Maximizing Your RCV Payout

Maximizing your RCV payout is not about arguing or deception. It is about process, documentation, and data. The chaotic, high-pressure environment of a typical roofing sale is designed to obscure financial details. Our approach is the opposite: we use a transparent, step-by-step methodology to create a predictable outcome. We weaponize predictability against the chaos of the industry.

Meticulous Documentation: The Foundation for a Full RCV Recovery

Recovering your full depreciation is contingent on proving the work was completed to the exact scope and cost approved by the insurer. Vague contracts and one-line estimates are invitations for claim denial. Our process is built on meticulous documentation. We use high-resolution photo evidence, precise measurements, and the same estimating software used by most major carriers, such as Xactimate. This ensures scope alignment from day one. Every line item is accounted for. This is the only way to guarantee claim accuracy and secure the release of your final payment without conflict.

From Vague Estimate to a Predictable Financial Plan

We do not provide ‘bids’ or ‘estimates’ in the conventional sense. We provide a complete financial roadmap. This plan details the approved scope of work from your insurer, the exact cost of the project, the ACV payment, your deductible, and the final recoverable depreciation amount. There are no hidden fees. There are no surprise charges. Any supplemental items required, such as unforeseen deck rot or necessary code upgrades, are documented and submitted to the insurer for approval *before* the work is done. This transforms a stressful, uncertain expense into a managed, predictable project.

Our Commitment to RCV: Why We Don’t Compromise on Materials or Protection

We build every roof to a full Replacement Cost Value standard because that is the only way to properly restore the structural integrity of your home’s most critical asset. An ACV-level repair is, by definition, a compromise. It uses inferior materials or cuts corners on labor to fit a depreciated budget. This approach is fundamentally incompatible with our commitment to long-term protection. Our pricing reflects the use of superior materials that can withstand wind and rain, adherence to modern construction standards, and a comprehensive workmanship warranty. We restore the full protective capability of your roof, ensuring it provides the necessary support and defense against extremes of temperature and sunlight for its entire intended lifespan. This is a non-negotiable quality standard.