A homeowner’s insurance claim for roof replacement is a formal process to secure financial indemnification for damage to a building’s primary protective covering. This process involves damage assessment, policy review, scope negotiation, and financial settlement to restore the roof system—the complete assembly of materials and constructions designed to shield the building’s walls and uprights from rain, snow, wind, and sun. The standard industry approach to this process is chaotic, marked by vague communication and unpredictable outcomes. Our methodology is the antithesis of this chaos. It is a systematic, transparent, and predictable protocol designed for homeowners who value precision and order.

Initial Damage Assessment: Quantifying Failure in Your Roof’s Protective System

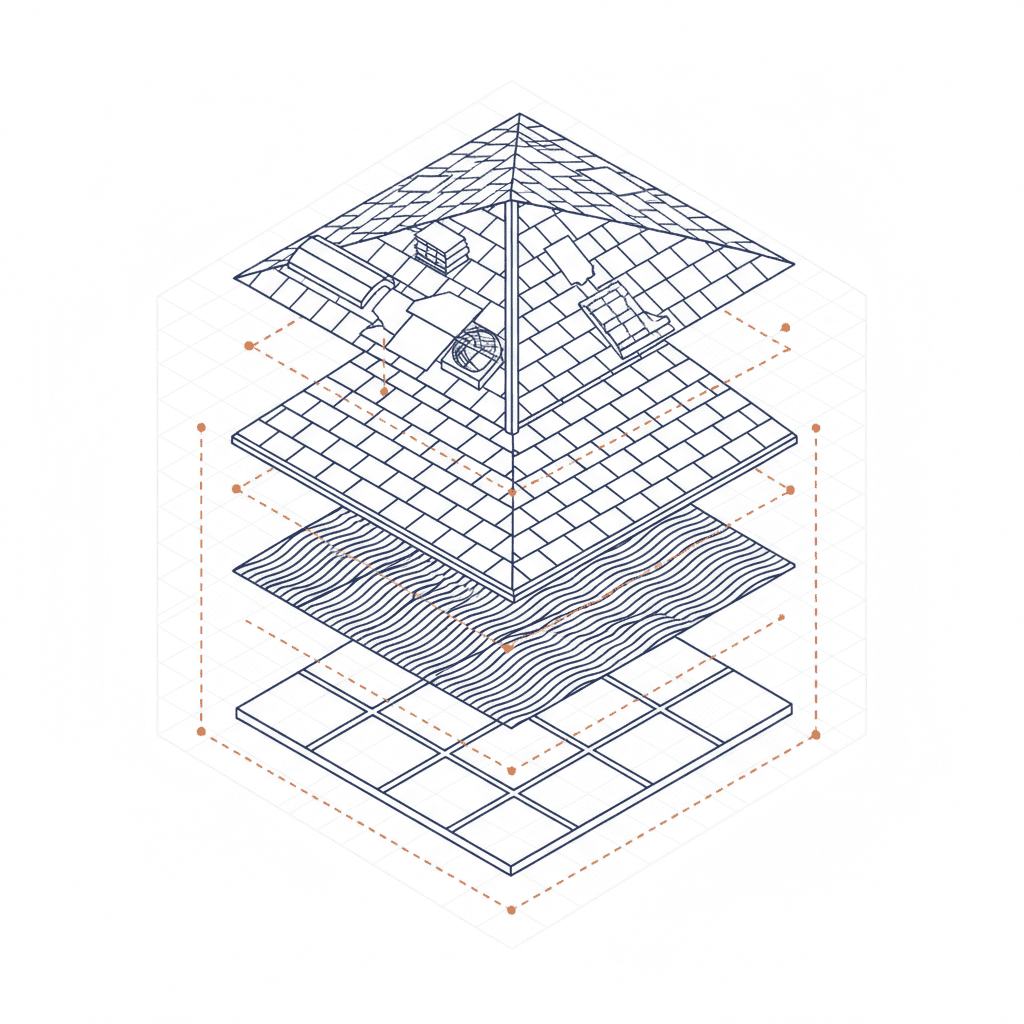

The first phase is a forensic analysis of your roofing system’s condition. A roof is not merely a cosmetic feature; it is an integrated system of materials responsible for the structural protection of your home. Any compromise to this system, whether from wind, hail, or other forces, represents a quantifiable failure. The objective of this assessment is to collect objective data that proves the extent of this failure and its impact on the building’s ability to provide protection against the elements.

Identifying Damage Sources: Wind, Rain, Snow, and Sunlight

Damage to a roofing system is a direct result of environmental forces exceeding the material’s tolerance. Understanding these sources is crucial for an accurate claim.

- Wind Damage: High winds create pressure differentials, resulting in wind uplift that can lift, bend, or remove shingles. This action breaks the sealant bond between shingles, creating entry points for water intrusion.

- Hail Damage: Hail impacts cause granule loss on asphalt shingles and can crack or puncture the underlying mat. This damage accelerates the degradation of the roof materials by exposing them to direct sunlight and moisture.

- Water Intrusion: This is not a primary damage source but a consequence of other failures. Once the protective barrier is breached, water can saturate the underlayment and roof deck, compromising the building’s structural integrity.

- Sunlight Degradation: Ultraviolet radiation breaks down roofing materials over time. Hail or wind damage that removes the protective granule layer exponentially accelerates this process, shortening the functional lifespan of the entire system.

Systematic Photo Documentation: Building Your Evidence File

Effective documentation is not arbitrary. It is the systematic creation of an evidence file to support your claim. This is a non-negotiable step for a data-driven process. The goal is to create a comprehensive photo log that leaves no room for subjective interpretation. Each photograph should be clear, well-lit, and contextualized. For example, a photo of a damaged shingle should be accompanied by a wider shot showing its location on the roof. This documentation should catalog every instance of damage, providing a visual record that directly corresponds to the line items in the future repair estimate.

Emergency Mitigation to Protect the Building Structure

If the roof’s ability to protect the building from rain is compromised, immediate mitigation is required. This is not a permanent repair but a necessary intervention to prevent catastrophic secondary damage to the home’s interior, walls, and uprights. Emergency roof tarping or temporary patching stops active leaks, protecting the structural integrity of your home while the insurance claim is processed. This action demonstrates responsible ownership to your insurance carrier and is a reimbursable expense under most policies. It is a logical first step in containing the scope of the failure.

Initiating the Claim: A Protocol for Precise Communication with Your Carrier

Once you have documented the damage, the next phase is to formally initiate the claim. This is not a casual phone call; it is the first step in a legal and financial process. Communication must be clear, concise, and factual. The goal is to provide your insurance carrier with the necessary data to open a file and assign an adjuster, establishing a clear record of communication from the outset.

Your First Report: The Essential Data to Provide

Your initial contact with your insurance provider must be efficient and precise. Have the following information prepared before you call:

- Policy Number: The unique identifier for your homeowner’s insurance contract.

- Date of Loss: The specific date the storm or event causing the damage occurred.

- Description of Loss: A factual, high-level description of the damage (e.g., \”My roof sustained significant hail damage from the storm on May 15th, causing granule loss and compromising its ability to shed water.\”).

- Contact Information: Ensure your phone number and email are current.

Upon reporting, you will be issued a claim number. This number is the central identifier for all future correspondence. Every interaction with the carrier—every phone call, email, and document submission—must be logged with a date, time, the representative’s name, and a summary of the conversation. This communication log is your project’s central nervous system.

Understanding Your Policy’s Coverage for Roof Materials and Construction

Your insurance policy is a contract defining the financial parameters of your roof replacement. You must understand two key concepts:

- Actual Cash Value (ACV): The value of your damaged roof after factoring in depreciation for age and wear. An ACV-only policy will not cover the full cost of a new roof.

- Replacement Cost Value (RCV): The total cost to replace the damaged roof with new materials of similar kind and quality, without a deduction for depreciation. Most modern policies are RCV.

Your deductible is the out-of-pocket amount you are contractually obligated to pay. This amount is subtracted from the total claim settlement. Understanding these terms is fundamental to financial planning for the project.

The Role of a Qualified Contractor vs. a Public Adjuster

A clear distinction must be made. A qualified roofing contractor is a technical expert responsible for assessing damage and executing the roof construction according to building codes and manufacturer specifications. A public adjuster is a licensed professional who negotiates the insurance claim settlement on your behalf for a fee. For most storm damage claims, a process-driven roofing contractor can effectively manage the scope of work and necessary supplements with the carrier’s adjuster. The contractor’s role is to provide the technical data required for the carrier to pay the claim correctly. Their estimate is the basis for the project’s scope of work.

The Adjuster Inspection: A Data-Driven On-Site Verification Process

The insurance adjuster’s visit is the pivotal moment of the claim process. Their role is to inspect the property, verify the damage reported, and create a scope of loss—a detailed list of necessary repairs. This is not an adversarial meeting. It is a collaborative, data-verification exercise. The objective is for your contractor and the adjuster to align on a complete and accurate scope of work based on tangible evidence.

Preparing for the Adjuster’s Visit: Data vs. Opinion

Success during the adjuster meeting depends entirely on preparation. Your contractor should be present for this meeting, not to argue, but to present the data collected during the initial assessment. This includes:

- A complete photo log of all damaged roofing system components.

- A detailed, line-item estimate outlining the required materials and labor.

- Knowledge of local building codes that mandate specific upgrades or construction methods.

The discussion must be grounded in objective data. The number of hail impacts per square, the linear feet of damaged gutters, the necessity of ice and water shield per code—these are facts, not opinions. A prepared presentation of this data eliminates ambiguity and facilitates an efficient agreement.

Aligning on the Scope: A Complete Inventory of Damaged Constructions

A roof is a system of interconnected components. A complete scope must account for every part of this construction that was damaged. This includes not just the primary roofing material, but also:

- Underlayment and decking

- Flashing around chimneys, vents, and valleys

- Ventilation systems (ridge vents, soffit vents)

- Gutters and downspouts

- Protective paint on vents and pipes

Agreement on the scope means both parties acknowledge all damaged line items that must be addressed to restore the roof to its pre-loss condition and comply with current building codes.

Navigating Discrepancies Between Contractor and Adjuster Valuations

It is common for an adjuster’s initial estimate to be lower than the contractor’s. This is rarely a sign of bad faith; it is often due to omissions or outdated pricing data in their software. When a discrepancy exists, the resolution is a supplemental claim. The contractor submits evidence (photos, code requirements, supplier invoices) to justify the need for additional line items or cost adjustments. This is a standard, data-driven negotiation process designed to reconcile the initial estimate with the factual requirements of the project. It is a predictable part of the workflow, not a crisis.

Decoding the Insurance Estimate: A Line-Item Financial Analysis

The insurance estimate, often generated using software like Xactimate, is the financial blueprint for your project. It is a complex document that requires careful analysis. You must audit this document line-by-line to ensure it fully funds a complete and correct roof replacement. Accepting an incomplete estimate is the primary cause of financial shortfalls and project chaos.

Financial Terminology: RCV, ACV, Depreciation, and Your Deductible

These four terms dictate the flow of money in your claim. A misunderstanding here leads to significant financial confusion.

| Term | Definition |

|---|---|

| Replacement Cost Value (RCV) | The total, non-depreciated cost to repair or replace the damaged property with materials of like kind and quality. This is the total project budget. |

| Depreciation | The reduction in value of your old roof due to age, wear, and tear. This amount is initially withheld by the insurance company. |

| Actual Cash Value (ACV) | The first check you receive. It is calculated as RCV minus Depreciation. (ACV = RCV – Depreciation). |

| Recoverable Depreciation | The withheld depreciation amount that is released to you once the contractor provides proof that the work is complete. This is your final check. |

| Deductible | Your contractually obligated contribution to the project. It is subtracted from the total RCV settlement. |

Verifying Quantities: Confirming Materials, Labor, and Code Upgrades

The insurance estimate must be audited for accuracy. Your contractor will verify that the quantities for materials (e.g., squares of shingles, linear feet of flashing) are correct. They will also confirm that the estimate accounts for all labor and required code upgrades. For instance, many municipalities now mandate the installation of an ice and water shield at the eaves and in valleys. If this is not included in the initial scope, it must be added via a supplement to ensure a code-compliant roof construction.

Identifying Omissions: The Anatomy of an Incomplete Estimate

Incomplete estimates are the primary source of conflict in the insurance restoration industry. A professionally managed project identifies and corrects these omissions before work begins. Common missing line items include:

- Starter strips and hip/ridge cap shingles

- Correct roof ventilation components

- Multiple layers of old roof tear-off and disposal

- General contractor overhead and profit (O&P) for project management

- Code-required drip edge or flashing

An under-scoped estimate does not fund a complete roof system. It funds a partial job. Correcting these omissions through the supplemental process is a mandatory step to ensure a successful outcome without unexpected costs.

The Anti-Chaos Mandate: A Predictable Process for Meticulous Homeowners

The entire insurance claim process is fraught with potential for disorganization, miscommunication, and financial surprises. This is the industry standard. We reject it completely. Our entire service is built on a simple premise: a major construction project on your home demands a predictable, transparent, and meticulously managed process. This is the only sane way to operate.

Your Dedicated Project Manager: A Single Point of Contact

The antidote to chaos is a single point of accountable contact. From the moment your project begins, you are assigned a dedicated Project Manager. This is not a salesperson; this is your operational lead. You will have their direct contact information. They are responsible for providing you with a clear communication cadence and regular project updates. You will never have to wonder about the status of your project. All questions, updates, and decisions flow through this single, organized channel. There are no surprises.

This is Not for Bargain Hunters: Our Commitment is to a Flawless Outcome

We must be direct. If your primary objective is to find the contractor with the absolute lowest price, we are not the right company for you. Our process is designed for meticulous homeowners who understand that a successful outcome is more valuable than a cheap price. Our commitment is to quality materials, expert craftsmanship, and flawless project management that protects your investment and eliminates stress. This level of service requires resources. We are structured to serve clients who prioritize long-term value and a predictable, well-managed experience over securing the lowest possible bid.

Executing Your Roof Replacement with Precision and Order

The construction phase is the physical manifestation of our process-driven philosophy. You will receive a detailed timeline before work begins. Our crews are trained to maintain a clean and organized job site, mitigating disruption to your property. We execute the scope of work with precision, adhering to manufacturer specifications and local building codes. Upon completion, a final inspection is conducted with your Project Manager to ensure every detail meets our quality standard and your expectations. This is how predictable construction is delivered.

Roof Replacement Insurance Claim: Frequently Asked Questions

Navigating an insurance claim generates valid questions. Here are direct answers to common homeowner concerns.

How Long Does a Roof Insurance Claim Typically Take?

The timeline for a roof insurance claim can range from a few weeks to several months. Key variables include the insurance carrier’s responsiveness, the complexity of the damage, and the need for supplemental negotiations. A typical, straightforward claim follows this general sequence: initial filing (1-2 days), adjuster inspection (1-2 weeks), initial payment (1-2 weeks after inspection), construction (1-3 days), and final payment (1-3 weeks after completion). A process-driven contractor can accelerate this by providing complete and accurate data upfront.

Will My Premiums Increase After an Act-of-God Claim?

Insurance carriers are generally prohibited from increasing an individual homeowner’s premiums as a direct result of a single weather-related claim, often termed an \”Act of God\” (e.g., wind or hail storm). However, if a specific geographic area experiences a high volume of claims, the carrier may raise rates for everyone in that risk pool upon policy renewal. Filing a legitimate claim to repair your damaged roof does not single you out for a rate hike; it is the function for which you pay premiums.

What if the Insurance Check is Less Than the Replacement Cost?

This is a common and expected scenario. The initial check (the ACV payment) is almost always less than the total replacement cost because the insurance company has withheld depreciation. Furthermore, the initial scope of loss from the adjuster may be incomplete. If the total approved amount (RCV) is still insufficient to cover the contractor’s estimate for a complete and correct repair, the solution is a supplemental claim. The contractor will submit the required documentation to the insurer to justify the additional costs. The goal is to ensure the final approved settlement matches the market cost to properly restore your roof system.