Foundational Insurance Requirements: A Framework for Mitigating Financial Exposure

Contractor insurance is a non-negotiable risk transfer mechanism designed to insulate your balance sheet from the significant financial liabilities inherent in commercial roofing operations, including property damage, bodily injury, and project-related accidents. As a fiduciary advisor responsible for capital asset preservation, you understand that selecting a contractor is not a procurement decision; it is a risk management decision. Choosing a vendor based on the lowest bid without rigorous due diligence on their insurance portfolio is a direct invitation for financial liability. An underinsured contractor effectively transfers their operational risk onto your asset, exposing your organization to litigation, capital loss, and severe operational disruption.

Our standard operating procedure begins with a forensic analysis of a contractor’s insurance framework. This is not about checking a box; it is about confirming a partner’s financial stability and their commitment to protecting your interests. The following coverages represent the absolute minimum for any contractor permitted to operate on a commercial property.

Commercial General Liability (CGL): Shielding Against Property & Third-Party Injury Claims

Commercial General Liability (CGL) is the primary shield protecting your asset from third-party claims for bodily injury and property damage. For a roofing project, this is critical. A dropped tool can injure a tenant; a mishandled piece of equipment can damage adjacent property or HVAC units. However, the most vital component for a fiduciary is the Completed Operations Coverage. This extension protects against property damage or bodily injury that occurs *after* the project is complete. A faulty seam that fails six months post-installation, leading to catastrophic water intrusion and inventory loss, falls under this coverage. Without it, you are left pursuing a contractor who may be unable to cover the damages, forcing the liability back onto your balance sheet.

Workers’ Compensation: Insulating Your Asset from On-Site Injury Liability

Workers’ Compensation insurance provides for medical care and wage replacement to a contractor’s employees injured on the job. Its function in your risk matrix is to provide the contractor’s employees with an exclusive remedy for workplace injuries, thereby shielding you, the property owner, from lawsuits. If a contractor’s employee is injured on your roof and the contractor lacks adequate Workers’ Compensation coverage, your organization can be held liable. This is a significant and entirely avoidable exposure. Furthermore, we analyze a contractor’s Experience Modification Rate (EMR). This is a data-driven metric that compares their history of workplace injury claims to the industry average. A contractor with an EMR below 1.0 has a better-than-average safety record. A high EMR is a leading indicator of poor safety protocols and a higher probability of an incident that could disrupt your operations and create liability.

Commercial Auto Liability: Covering Transit-Related Risks and Site Incidents

While seemingly administrative, Commercial Auto Liability is a crucial component of a comprehensive risk management plan. This policy covers vehicles used for the business, including fleet vehicles and potentially employees’ personal vehicles used for work purposes (Hired and Non-Owned Auto coverage). A roofing project involves the transport of heavy materials, large equipment, and waste disposal. An accident involving a contractor’s vehicle on your property or in transit to your site can trigger complex liability claims. Verifying this coverage ensures that this specific, predictable risk is properly assigned to the contractor’s insurer, not yours.

Advanced Coverage Analysis: Aligning Policy Limits with Asset Value

Basic coverage is insufficient for protecting a high-value capital asset. A sophisticated risk management approach requires aligning the contractor’s policy limits and endorsements with the true financial exposure of your facility, including property value, tenant operations, and potential business interruption costs. Simply accepting a standard $1 million policy for a $20 million facility is a failure of fiduciary duty.

Umbrella/Excess Liability: Extending Protection for High-Value Assets

An Umbrella or Excess Liability policy sits on top of the primary CGL, Auto, and Employer’s Liability policies. Its sole purpose is to provide additional financial limits in the event of a catastrophic loss that exhausts the primary policies. For high-value commercial assets, or facilities with sensitive operations (e.g., data centers, manufacturing, healthcare), robust umbrella coverage is non-negotiable. The required limit should be a calculated decision based on a worst-case scenario analysis, factoring in not just replacement costs but the financial impact of operational downtime. This is a strategic determination of risk tolerance, not an arbitrary number.

Decoding Policy Limits: Per-Occurrence vs. General Aggregate Explained

Understanding the structure of a CGL policy is critical to avoid discovering coverage gaps after an incident. Policy limits are not a single number; they are typically bifurcated into a per-occurrence limit and a general aggregate limit. A failure to analyze both exposes your asset to significant risk, particularly if your contractor is engaged in multiple projects concurrently.

| Policy Component | Per-Occurrence Limit | General Aggregate Limit |

|---|---|---|

| Definition | The maximum amount the insurer will pay for any single incident or claim. | The maximum total amount the insurer will pay for all claims during the policy period. |

| Fiduciary Risk | Must be sufficient to cover a plausible worst-case incident at your specific facility. | This limit can be eroded or exhausted by claims from other projects, leaving your project unprotected. |

| Verification Action | Align this limit with asset value and potential business interruption costs. | Consider requiring a per-project aggregate endorsement to isolate your project’s coverage from others. |

Critical Endorsements for Commercial Roofing Operations

An endorsement is a modification to an insurance policy that alters its scope. For commercial construction, certain endorsements are mandatory for effective risk transfer. A policy without them may contain exclusions that nullify the intended protection.

- Additional Insured: This endorsement extends the contractor’s liability coverage to include you, the property owner. It is one of the most effective contractual risk transfer tools available.

- Waiver of Subrogation: This prevents the contractor’s insurance carrier from seeking to recover paid claim amounts from you, even if you are partially at fault. It effectively isolates your own insurance from the claim.

- Primary and Noncontributory: This language dictates the order of response. It ensures the contractor’s policy responds first (primary) and without seeking contribution from your policy (noncontributory).

The Verification Mandate: A Fiduciary’s Protocol for Vetting Contractor Compliance

Receiving a Certificate of Insurance (COI) is not the end of the due diligence process; it is the beginning. A COI is merely a snapshot in time and is not a guarantee of coverage. A disciplined, process-driven verification protocol is required to confirm compliance and protect the asset.

The Strategic Importance of ‘Additional Insured’ Status

Securing status as an Additional Insured on a contractor’s CGL policy is the cornerstone of contractual risk transfer. This legal standing grants you direct protection under their policy, obligating their insurer to defend you against lawsuits and pay claims arising from the contractor’s work on your property. When coupled with Primary and Noncontributory language, it creates a formidable barrier that insulates your own insurance program and preserves your loss history, preventing future premium increases.

Assessing Insurance Carrier Solvency: A.M. Best Ratings and Financial Stability

An insurance policy is a promise to pay. The financial stability of the issuing carrier determines their ability to honor that promise after a catastrophic loss. A.M. Best is the industry-standard rating agency for insurer solvency. Engaging a contractor insured by a low-rated or unrated carrier introduces counterparty risk. If that carrier becomes insolvent, the policy is worthless, and the liability reverts directly to the contractor and, ultimately, to you. Mandating a minimum A.M. Best rating of ‘A-‘ (Excellent) is a fundamental tenet of prudent risk management.

RocStout’s Compliance Framework: Eliminating Insurance-Related Project Risk

At RocStout, we operate as fiduciary partners. Our approach to insurance and risk management is not a passive, administrative function but an active, integrated component of our project delivery model. We build a framework of compliance designed to provide you with absolute fiscal certainty and eliminate the primary source of owner-contractor disputes and financial losses.

Our Non-Negotiable Insurance Mandates for All Project Stakeholders

Our insurance requirements are engineered to create a protective shell around your asset. We maintain CGL and Umbrella liability limits that meet the demands of high-value properties and institutional owners. More importantly, we enforce these same stringent requirements on every subcontractor and vendor that sets foot on your property. Through detailed Master Service Agreements and indemnification clauses, we create a clear, unbroken chain of liability that flows away from you. This systematic vetting process eliminates the common industry vulnerability of an uninsured subcontractor causing a major loss.

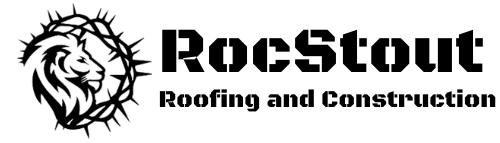

Integrating Compliance into Project Management to Prevent Operational Disruption

Our rigid adherence to insurance compliance is the foundation that enables us to promise and deliver zero operational disruption. By properly capitalizing and insuring against project risks upfront, we remove the financial uncertainty that plagues typical construction projects. This allows our project management team to focus exclusively on execution: strict schedule adherence, proactive tenant communication, and rigid OSHA safety protocols. This methodology transforms your roofing project from a unpredictable liability into a predictable capital expenditure. With RocStout, you are not just buying a roof; you are investing in operational continuity and the preservation of your capital asset.