Executive Summary: Framing the Roof as a Financial Asset, Not an Expense

The decision between a commercial roof restoration and a full replacement represents a fundamental divergence in capital planning strategy, directly impacting your building’s total cost of ownership (TCO) and operational risk profile. As fiduciaries responsible for asset value, facility managers and CFOs must move beyond the reactive ‘fix-a-leak’ mindset. The roof is not a recurring expense; it is a critical component of the building envelope, a depreciating asset whose lifecycle must be managed with fiscal precision. Understanding this distinction is the foundation of responsible asset lifecycle management and the first step toward mitigating unforeseen liabilities.

Defining Commercial Roof Restoration: Extending Asset Life via System Renewal

A commercial roof restoration is an engineered process of renewing a structurally sound, existing roof membrane to a ‘like-new,’ warrantable condition. This is achieved by applying a fluid-applied, seamless membrane system—such as silicone, acrylic, or polyurethane—over the prepared surface of the original roof. From a financial perspective, this is a strategic maintenance procedure classified as an operating expense (OpEx). Its primary objective is service life extension, deferring the significant capital expenditure of a full replacement by 10 to 20 years. This preventative maintenance approach seals all existing seams, penetrations, and potential points of water ingress, creating a monolithic barrier against the elements without the operational disruption of a tear-off.

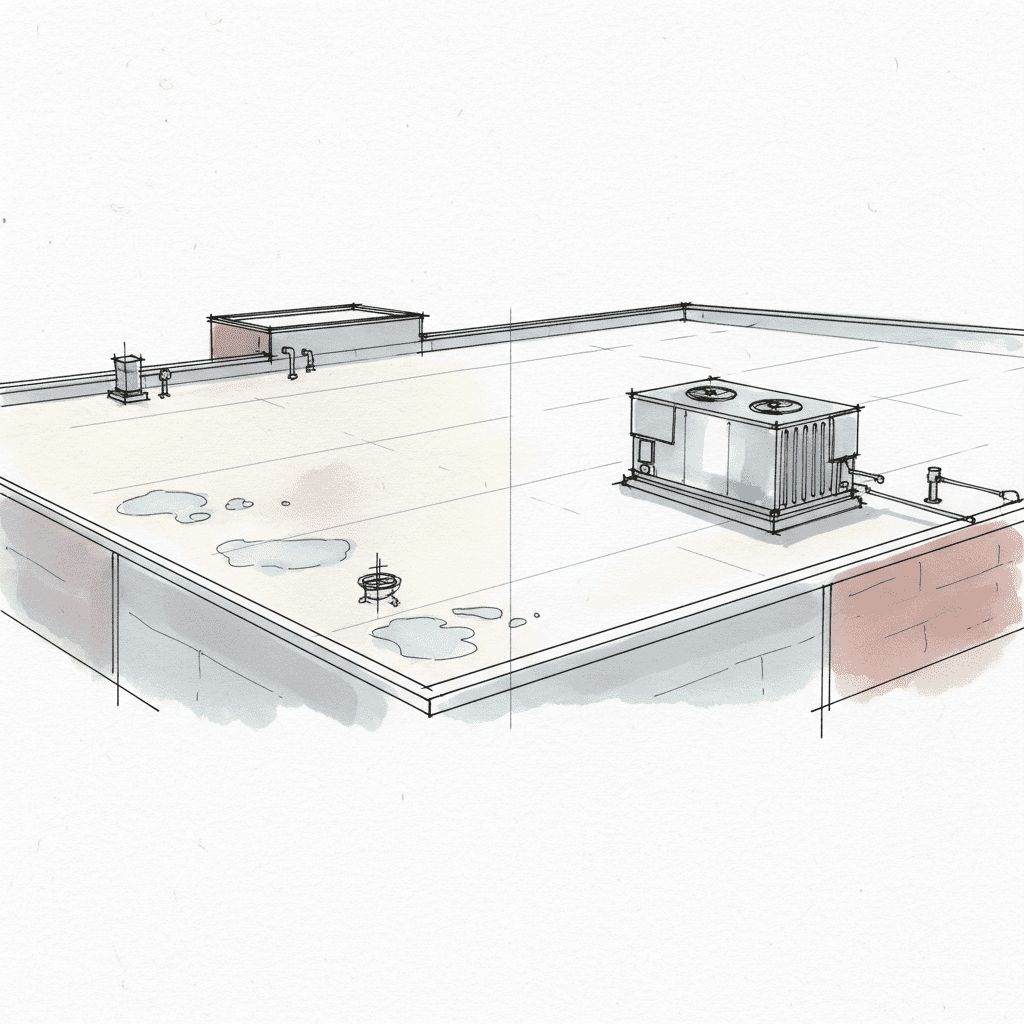

Defining Commercial Roof Replacement: A Full Capital Redeployment

A commercial roof replacement is a full capital improvement project involving the complete tear-off and disposal of the existing roof system down to the structural deck. A new system, including insulation, membrane, and flashing, is then installed in compliance with current building codes. This is unequivocally a capital expenditure (CapEx) that is capitalized and placed on a depreciation schedule. A replacement is non-negotiable when the existing system has failed, insulation is widely saturated, or the structural deck itself is compromised. It represents a complete redeployment of capital to restore the building envelope’s integrity and reset its asset lifecycle, often providing an opportunity to upgrade thermal performance and wind uplift ratings.

The Fiduciary’s Diagnostic Framework: Data-Driven Decision Criteria

Responsible capital planning forbids guesswork. The choice between restoration and replacement can only be made following a forensic roof assessment that provides quantifiable, objective data. At RocStout, our Standard Operating Procedure rejects subjective ‘visual inspections’ in favor of non-destructive testing and engineering analysis. We utilize technologies like infrared thermography to identify subsurface moisture and conduct core sample analysis to verify the composition and integrity of the entire roof assembly. This data-driven approach removes financial ambiguity and provides the fiscal certainty required to make a defensible investment decision based on the verified integrity of the substrate.

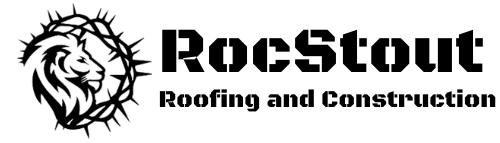

Moisture Saturation Analysis: The Critical 25% Threshold for Insulation Integrity

The single most critical metric determining the viability of a roof restoration is the percentage of saturated insulation within the system. Using thermal imaging and corroborating core samples, we create a precise moisture map of the entire roof. If less than 25% of the insulation is wet, a restoration is a viable and fiscally prudent option. This involves the surgical removal and replacement of only the compromised sections before the new seamless membrane is applied. However, once moisture saturation exceeds this 25% threshold, the systemic R-value degradation and potential for structural deck corrosion make a full replacement the only responsible path forward. Continuing to operate with widespread wet insulation is a direct financial drain due to significant energy loss and a precursor to catastrophic failure.

Membrane Condition Evaluation: Quantifying Brittleness, Blistering, and Seam Failure

The condition of the existing membrane—whether it is TPO, EPDM, or modified bitumen—dictates its ability to serve as a stable substrate for a restoration coating. Our evaluation quantifies the extent of UV degradation, which manifests as brittleness, shrinkage, and cracking. We meticulously inspect all seams, curbs, and penetrations, as seam integrity failure is the leading cause of water ingress. Blistering indicates trapped moisture or air between membrane layers, a critical flaw that must be addressed. A membrane that is too far degraded cannot be restored; applying a coating over a failing substrate is a negligent practice that merely hides a ticking financial time bomb.

Structural Deck Assessment: Ensuring the Viability of the Building’s Foundation

The structural deck is the non-negotiable foundation of your entire roofing asset. Before any project is considered, its integrity must be verified. We conduct fastener pull-out tests to confirm the deck can meet engineered wind uplift ratings and inspect for any signs of rust or deck corrosion, particularly in steel and concrete decks. If there is any question about the structural load capacity or substrate viability, we mandate consultation with a structural engineer. An overlay or restoration on a compromised deck is not just a wasted investment; it’s a significant liability that jeopardizes the entire building envelope and the safety of its occupants.

A Comparative ROI Analysis: Modeling Long-Term Financial Performance

A sophisticated capital budgeting process evaluates not just the initial outlay but the long-term return on investment (ROI) and net present value (NPV) of each option. The decision to restore or replace must be modeled based on its direct impact on cash flow, tax liabilities, energy expenditures, and projected maintenance costs. This financial modeling provides a clear picture of the lifecycle cost of your roofing asset.

Initial Outlay: Restoration as an OpEx vs. Replacement as a Depreciable Asset

The tax implications of this decision are significant and directly impact your organization’s cash flow. A restoration is typically classified as a maintenance expense, allowing the full cost to be deducted from taxable income in the year it is incurred under IRS Section 179. A full replacement, conversely, is a capitalized cost that must be depreciated over 39 years for commercial properties. While the initial cash outlay for a restoration is significantly lower, the tax treatment provides an immediate and substantial financial benefit.

| Financial Metric | Roof Restoration | Roof Replacement |

|---|---|---|

| Classification | Operating Expense (OpEx) | Capital Expenditure (CapEx) |

| Tax Treatment | Potentially 100% tax-deductible in the current year (IRS Section 179) | Depreciated over 39 years |

| Initial Cost | Typically 50-70% lower than replacement | Full capital investment |

| Cash Flow Impact | Minimal immediate impact due to lower cost and tax deduction | Significant immediate impact requiring capital budgeting |

Energy Efficiency Calculations: ROI from Reflective Coatings & R-Value Improvements

Modern roofing systems are active contributors to your building’s energy performance. Most restoration coatings are highly reflective ‘cool roof’ systems with a high Solar Reflectance Index (SRI). They can lower rooftop temperatures by 50-70 degrees, significantly reducing the HVAC load on your building and generating tangible utility cost savings of 15-30%. A full replacement offers the opportunity to increase the R-value of the entire roof by installing thicker polyisocyanurate insulation, creating an even greater long-term return through energy savings. We model these savings to project a clear ROI timeline for either investment.

Warranty and Maintenance Projections: Quantifying the Total Cost of Ownership

The lowest bid is a financial illusion that hides the true total cost of ownership. A properly executed restoration or replacement from a certified contractor comes with a comprehensive manufacturer’s NDL (No Dollar Limit) warranty backed by a contractor workmanship warranty. This combination provides fiscal certainty by eliminating the risk of unforeseen repair costs for a defined period (typically 15-30 years). In contrast, choosing a low-bid, non-certified contractor for a patch job or an improper overlay introduces immense financial risk. Their warranties are often worthless, leaving you liable for every subsequent failure. Proactive asset preservation via a warrantable system is the only way to lock in predictable maintenance costs.

Operational Risk & Liability Mitigation: A Comparative Analysis

For any operating business, the true cost of a roofing project is not measured in materials and labor, but in the potential for operational disruption. Tenant satisfaction, employee safety, and business continuity are paramount financial considerations. A roofing project managed without a rigid focus on these factors is a direct threat to your revenue and reputation. This is why risk management must be at the core of the contractor selection process.

Minimizing On-Site Disruption: The Low-Impact Profile of Restoration Projects

A roof restoration project offers a clear advantage in preserving business continuity. The process is significantly quieter, generates minimal debris, and often involves low-to-zero VOC (volatile organic compound) materials. There is no disruptive tear-off phase, which is the source of the most significant noise and site logistics challenges in a replacement project. For sensitive environments like hospitals, data centers, or occupied commercial offices, the low-impact profile of a restoration is a powerful operational benefit that protects tenant relationships and prevents costly downtime.

Project Timelines & Certainty: Contrasting Restoration Speed with Replacement Complexity

Time is a financial asset. Restoration projects are typically completed in 30-50% less time than a full replacement. This compressed project schedule reduces your facility’s exposure to weather delays and other on-site risks. A full replacement is a logistically complex operation involving tear-off, disposal, staging of new materials, and a lengthy permitting process, all of which are vulnerable to supply chain risk and unpredictable delays. The speed and predictability of a restoration project provide a level of schedule certainty that is critical for capital planning and operational stability.

Liability Exposure: The Financial Consequences of Negligent Contractor Selection

Choosing a roofing contractor based on the lowest price is a direct assumption of financial liability. A single mistake by an unqualified crew—improperly sealed flashing, a forgotten tool, or failure to secure the site overnight—can lead to catastrophic water ingress. This event triggers a cascade of financial consequences: damaged inventory, ruined equipment, business interruption, and denied insurance claims. Furthermore, a poorly managed worksite creates slip and fall hazards, inviting OSHA violations and personal injury lawsuits. The reputational risk among tenants and customers can be permanent. A premium, process-driven contractor is not a cost; it is a risk management investment that insulates your organization from these preventable liabilities.

The RocStout Protocol: Engineering Fiscal Certainty into Your Asset Plan

We operate as fiduciary partners, not contractors. Our entire methodology is engineered to eliminate variables and deliver the fiscal certainty your capital planning process demands. We achieve this through a rigid, repeatable set of standard operating procedures (SOPs) that transform a complex construction project into a predictable business process. We do not compete on price; we compete on operational continuity and long-term asset value.

Our Diagnostic SOP: A Repeatable, Engineering-Led Approach to Assessment

Our process begins with a comprehensive, data-driven assessment that forms the basis of a formal Asset Condition Report. This is not a sales estimate; it is an objective analysis designed to integrate directly into your capital budgeting.

Execution with Precision: Mitigating Operational Disruption by Design

Our commitment to data-driven analysis is matched only by our obsession with disciplined execution. Every RocStout project is managed by a dedicated project manager who enforces strict adherence to safety protocols, schedule, and budget. Our zero-incident culture is non-negotiable, and our safety protocols meet or exceed all OSHA compliance standards. Before a single tool is brought on-site, we develop and deliver a comprehensive Tenant Relations Plan, outlining project hours, site logistics, and communication channels. Our standard is ‘water-tight-by-nightfall,’ ensuring your asset is protected at every stage of the project. This methodical approach is how we deliver on our core promise: protecting your capital asset while ensuring absolute operational continuity.