Deconstructing the Low Bid: A Capital Risk Assessment for Fiduciary Asset Managers

For a fiduciary asset manager, a low-bid commercial roof proposal is not a cost-saving opportunity; it is an unvetted financial liability that introduces unacceptable risk to your capital asset. The true cost of a roofing system is not measured by the initial invoice but by its Total Cost of Ownership (TCO) over a 10 to 20-year service life. Choosing the lowest bidder is a strategic decision to accept higher operational risk, increased maintenance liabilities, and the high probability of premature system failure—directly threatening asset valuation and tenant stability. This is not a construction project; it is a critical capital planning decision with long-term financial consequences.

The Initial vs. Lifecycle Cost Fallacy: A Financial Modeling Breakdown

The appeal of a low initial capital expenditure (CapEx) is a dangerous siren song for asset managers. It obscures the predictable, and often substantial, downstream costs associated with inferior materials and workmanship. A comprehensive lifecycle cost analysis reveals that a properly engineered and installed roofing system, while having a higher initial cost, delivers a significantly lower TCO and a more predictable return on investment (ROI). Unplanned maintenance, energy loss from substandard insulation, and business interruption costs quickly erode any initial savings. A properly funded capital reserve study must account for the high probability of these expenses when a low-bid path is chosen. The financial model below quantifies this reality.

| Financial Metric (10-Year Model) | Scenario A: Low-Bid Contractor | Scenario B: RocStout Fiduciary-Grade System |

|---|---|---|

| Initial Capital Expenditure (CapEx) | $250,000 | $325,000 |

| Projected Unplanned Maintenance (Yrs 1-5) | $35,000 | $2,500 (Proactive Inspections) |

| Projected Unplanned Maintenance (Yrs 6-10) | $70,000 | $5,000 (Proactive Inspections) |

| Annual Energy Loss (Substandard Insulation) | $8,500/yr (Total: $85,000) | $0 (Code-Compliant R-Value) |

| Business Interruption Risk Cost (Est.) | $50,000 (Leak Damage/Downtime) | $0 |

| Premature Replacement (System Failure Yr 12) | $450,000 | $0 (System performs for 20+ years) |

| Total Cost of Ownership (10-Year) | $490,000 | $332,500 |

How Low Bids Directly Translate to Increased Operational Liability

A low-bid roof is a balance sheet liability from the moment of installation. Premature failure is not a risk; it is a statistical certainty. This failure manifests as water intrusion, which leads to a cascade of financial damages including inventory loss, damage to interior finishes, and the potential for mold remediation. For multi-tenant facilities, the consequences escalate to include tenant displacement, lease termination, and legal exposure. These events trigger business interruption insurance claims, which invariably lead to higher future premiums. The core fiduciary duty is to preserve asset value and ensure operational continuity; a low-bid roof actively undermines both objectives by introducing unmanaged and unnecessary risk.

Material Specification Deviations: The Root of Premature System Failure

The primary method for achieving a low bid is through the deviation from architect-specified materials. This practice, sometimes deceptively labeled ‘value engineering,’ involves substituting specified components with cheaper, thinner, or non-compliant alternatives. These deviations are often concealed within complex submittals, invisible to an untrained eye but catastrophic to the long-term performance of the roofing system. Adherence to ASTM standards and manufacturer specifications is not optional; it is the baseline requirement for a warrantable, long-term asset.

Compromised Thermoplastic Membranes (TPO/PVC): Seam Welds and UV Degradation

In thermoplastic roofing systems, performance is dictated by membrane thickness and the integrity of its heat-welded seams. A low-bid contractor will often substitute a specified 60-mil or 80-mil membrane with a thinner 45-mil alternative. This thinner membrane has drastically lower puncture resistance and succumbs to UV degradation and thermal stress years ahead of schedule. Furthermore, improper heat weld parameters—a result of unskilled labor—create brittle seams that fail under thermal cycling, creating extensive entry points for water. This is a direct compromise of the building envelope’s primary defense.

Bitumen & Asphaltic System Failures: Adhesion and Ply Delamination

For modified bitumen or built-up roofing (BUR) systems, the cost-cutting occurs in the asphalt and the number of plies. Low-bid installers may use asphalt heated to improper temperatures, resulting in poor adhesion between plies. This leads to interply blistering and, eventually, delamination. They may also omit a specified ply layer entirely to reduce material and labor costs. The result is a system incapable of withstanding thermal shock and building movement, leading to widespread splitting and catastrophic failure well before its designed service life.

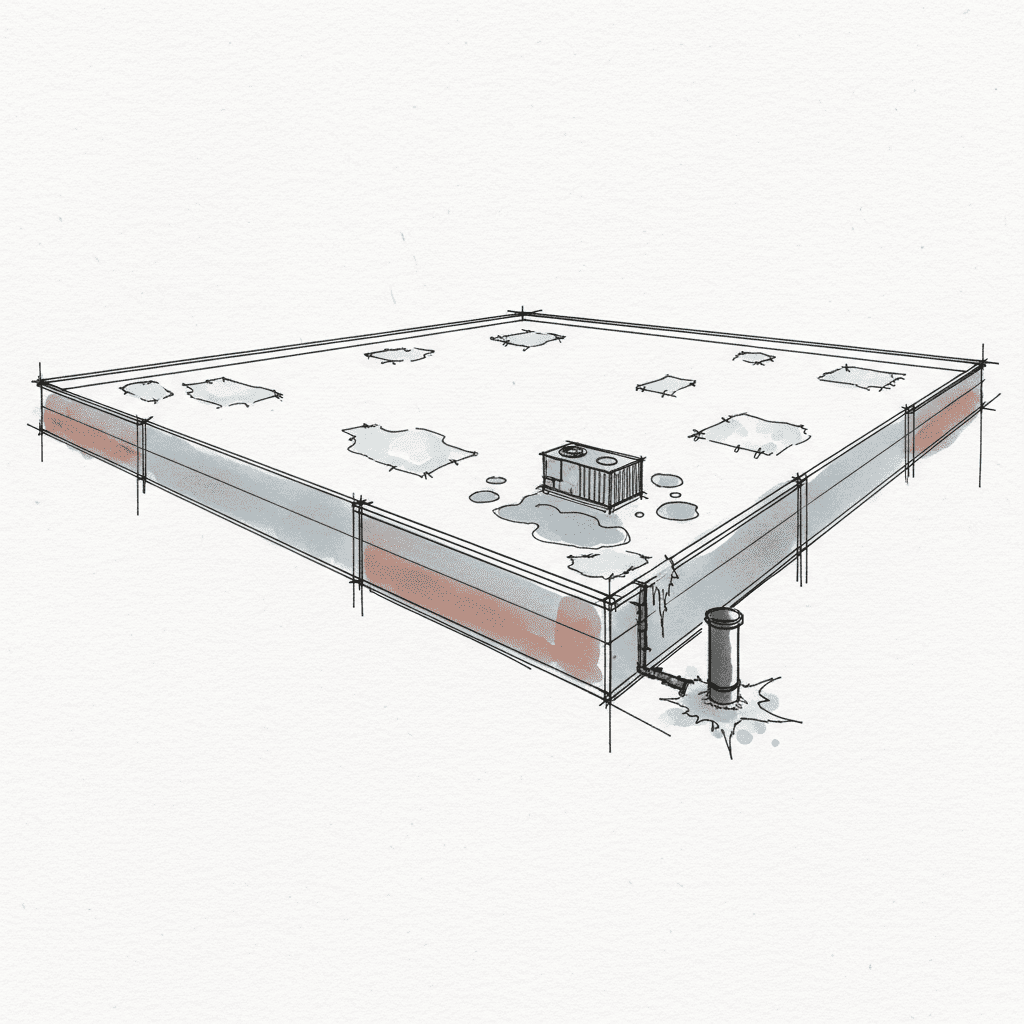

Substandard Insulation and Fasteners: The Hidden Threat to Structural Integrity

Beneath the membrane lies a critical component of the system’s structural and thermal performance: the insulation and fastening pattern. Low-bid proposals often substitute specified high-compressive-strength polyisocyanurate (ISO) insulation with a lower-density product. This cheaper board crushes under foot traffic and equipment loads, causing the membrane above to stretch and fail. Critically, they may use insufficient fasteners or fasteners of the wrong type, failing to meet engineered wind uplift requirements. A failed fastener pull-out test means the entire roof is at risk of being peeled back in a significant wind event, a total loss scenario for the asset owner.

Workmanship Deficiencies: The Unseen Liability in Discounted Labor

A roofing system is only as robust as its installation. Discounted labor directly correlates with a lack of skilled, certified technicians and a disregard for quality control. Manufacturer’s warranties are explicitly voided by improper installation, leaving the building owner with no recourse when—not if—the system fails. Every workmanship deficiency is a latent liability that will eventually manifest as water infiltration and operational disruption.

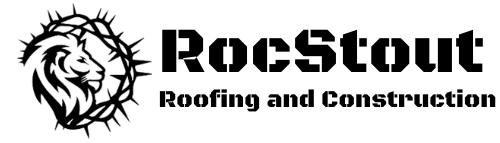

Improper Drainage Engineering: The Financial Impact of Ponding Water

Positive drainage is a non-negotiable engineering requirement. Ponding water, defined as water remaining on a roof surface 48 hours after a rain event, accelerates membrane degradation exponentially and adds significant, unplanned structural load to the building. Low-bid contractors cut costs by omitting or improperly designing tapered insulation systems. This failure to engineer proper roof slope towards drains and scuppers is a fundamental violation of roofing best practices. The resulting weight of ponding water can exceed the structural load capacity of the deck, creating a risk of collapse and voiding all manufacturer warranties.

Neglecting Critical Flashings and Penetration Seals: Primary Points of Ingress

An estimated 90% of all roof leaks originate at flashing details and penetrations—HVAC curbs, vents, pipes, and expansion joints. This is intricate, time-consuming work that requires highly skilled labor. It is the first area a low-bid contractor will compromise. Using incorrect materials, failing to properly adhere termination bars, or improperly sealing penetrations creates immediate pathways for water intrusion. These are not minor deficiencies; they are the primary points of failure that cause the most significant interior damage.

Compliance & Liability Exposure: The Unaccounted Risks of Low-Bid Contracts

Engaging a low-bid contractor is an explicit acceptance of compliance risk. These contractors often operate outside the boundaries of building codes and safety regulations, exposing the asset owner to stop-work orders, fines, and significant legal liability. A properly structured contract with robust indemnification clauses is critical, but it cannot protect you from a contractor who lacks the financial stability or insurance coverage to honor it.

Violating Building Codes & Wind Uplift Requirements (ASCE 7)

Commercial roofing is governed by strict regulations, including the International Building Code (IBC) and ASCE 7 standards for wind uplift. These codes dictate specific fastening patterns and material requirements based on the building’s geographic location and height. Low-bid contractors frequently ignore these requirements to save on fasteners and labor. A municipal code enforcement inspection can result in a stop-work order and a mandate to tear off the non-compliant system at the owner’s expense. In a severe weather event, a non-compliant roof can lead to a catastrophic failure for which the owner, not just the contractor, is liable.

Insufficient Insurance and Bonding: Exposing Your Asset to Catastrophic Loss

A contractor’s Certificate of Insurance (COI) is a critical due diligence document. Low-bid operators often carry minimum-limit general liability and worker’s compensation policies that are inadequate for a commercial project. An accident on-site could quickly exhaust their coverage, leaving the property owner exposed to litigation. Furthermore, the absence of a surety bond means that if the contractor defaults or fails to perform, the owner has no financial mechanism to complete the project without incurring the full cost of hiring a new firm. This transfers 100% of the performance risk directly to your balance sheet.

Quantifying the Cost of Operational Disruption From Inept Contractors

The greatest enemy to any facility manager or CFO is operational disruption. The true cost of a roofing project includes the impact on tenants, revenue, and staff productivity. Inept contractors, the hallmark of the low-bid world, lack the project management discipline to execute a project without causing significant and costly interference with your core business operations. This is not a construction nuisance; it is a direct financial drain.

Schedule Overruns and Their Direct Impact on Revenue and Tenant Relations

Low-bid contractors are chronically unreliable. They lack the logistical expertise and dedicated project management to adhere to a critical path schedule. Delays mean extended noise, debris, and access restrictions, which can lead to tenant complaints, demands for rent abatement, and potential lease terminations. A professional, process-driven contractor provides a detailed project schedule, a clear tenant communication plan, and manages site logistics to ensure your business continues to function with minimal interruption. Every day of delay is a day of lost revenue and increased risk.

OSHA Violations and On-Site Safety Hazards: A Threat to Tenants, Staff, and Brand Reputation

A disorganized and unsafe job site is a direct reflection of the contractor’s professionalism and a massive liability for the property owner. OSHA violations, such as inadequate fall protection or hazard communication failures, can lead to project shutdowns and severe fines. More critically, an on-site accident involving a tenant, employee, or visitor creates a legal and public relations catastrophe. A fiduciary-grade contractor operates under a strict, documented job site safety plan, viewing OSHA compliance not as a burden but as a standard operating procedure for protecting your asset and your reputation.

A Framework for Fiscal Certainty in Commercial Roofing Asset Management

The alternative to the high-risk, low-bid approach is a partnership centered on risk management and predictable capital planning. A commercial roof should not be a source of financial surprises. It is a manageable asset class that, when approached with engineering discipline and a long-term financial perspective, can provide 20-30 years of reliable performance. This requires a shift from reactive repair to proactive asset preservation.

The RocStout SOP: Engineering-Led Scope Development & Transparent Reporting

We reject the model of providing a price based on a simple square footage measurement. Our Standard Operating Procedure (SOP) is designed to deliver fiscal certainty through a rigorous, data-driven process. It transforms a volatile capital expense into a planned, predictable investment in asset preservation.

Beyond Installation: Implementing a Proactive Roof Lifecycle Management Plan for Predictable CapEx

The project’s completion is the beginning of our partnership. To protect your investment and ensure predictable capital budgeting, we implement a proactive roof lifecycle management plan. This includes a scheduled roof inspection program to identify and address minor issues before they become costly failures, ensuring warranty compliance. This transforms your roof from a reactive liability into a managed asset with a predictable maintenance budget and a maximized service life, providing the fiscal certainty that is the cornerstone of responsible asset management.