Quantifying the Financial Impact of Solar Heat Gain on Commercial Assets

A high-reflectivity commercial roof, commonly known as a ‘cool roof,’ is a building envelope system engineered to lower a facility’s total cost of ownership by reducing solar heat gain and mitigating long-term operational expenditures. For the fiduciary asset manager, this is not a maintenance item; it is a capital investment with a measurable impact on HVAC energy consumption, asset longevity, and regulatory compliance. The decision to install such a system moves beyond a simple repair and becomes a strategic component of your capital asset preservation plan.

Choosing the lowest bid for commercial roofing is a well-documented financial liability. It prioritizes a short-term budget line over long-term asset integrity, inviting operational disruption, inventory damage, and tenant disputes. At RocStout, we operate as fiduciary advisors. Our standard is to analyze the roof not as a standalone component, but as an integral part of your building’s financial performance. This analysis begins with quantifying the primary adversary to your OpEx budget: uncontrolled solar heat gain.

Defining Cool Roof Systems: Solar Reflectance and Thermal Emittance Metrics

To make an investment-grade decision, you must understand the key performance indicators (KPIs) that govern a cool roof’s financial efficacy. These are not arbitrary numbers; they are standardized metrics established by bodies like the Cool Roof Rating Council (CRRC) and recognized by ENERGY STAR. The two primary metrics are:

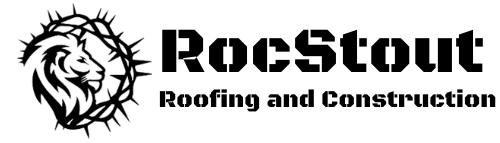

- Solar Reflectance (Albedo): This measures the fraction of solar energy reflected by the roof surface. A higher value (closer to 1.0) indicates that more sunlight is being reflected away, rather than absorbed as heat. A dark, conventional EPDM roof may have a reflectance of 0.10, absorbing 90% of solar energy. A white TPO or PVC cool roof can have a reflectance of 0.80 or higher, absorbing only 20%.

- Thermal Emittance: This measures the roof’s ability to radiate absorbed heat back into the atmosphere. A high emittance value (closer to 1.0) allows the surface to cool rapidly after sundown.

The combination of these two values produces the Solar Reflectance Index (SRI), a 0-100 scale that provides a comprehensive measure of a roof’s ability to reject solar heat. A higher SRI value translates directly to a lower roof surface temperature and, consequently, reduced heat transfer into your facility.

The Urban Heat Island Effect and its Impact on Peak Demand Charges

Your facility does not operate in a vacuum. It is part of a larger ecosystem, often a dense urban or suburban environment where dark, heat-absorbing surfaces (roofs, asphalt) create an ‘urban heat island.’ This phenomenon elevates ambient temperatures, forcing your HVAC systems to work harder and longer, especially during peak afternoon hours. This directly impacts your utility costs in two ways: higher overall energy consumption (kWh) and, more critically, exposure to peak demand charges. Utilities levy these charges based on the highest level of electricity usage during a billing period. A cool roof directly mitigates this financial risk by reducing the building’s energy demand during the hottest parts of the day, thereby lowering your peak load and protecting your budget from punitive utility rates.

Initial Capital Outlay (CapEx) vs. Long-Term Asset Valuation

The initial capital expenditure for a high-performance cool roof system may be moderately higher than a conventional, dark-colored membrane. However, a responsible lifecycle cost analysis reveals this premium to be a strategic investment, not an incremental cost. By lowering HVAC operational expenditures, reducing strain on capital equipment (extending its lifespan), and deferring future roof replacement due to reduced thermal stress, the cool roof generates a clear return on investment. This shifts the expenditure from a simple maintenance line item subject to depreciation into a capital improvement that enhances the asset’s valuation and marketability.

Core Data Inputs for an Accurate Cool Roof ROI Calculation Model

Fiscal certainty is achieved through rigorous financial modeling, not approximation. At RocStout, our capital planning protocol is built on a foundation of precise data inputs to create an accurate pro forma analysis for your roofing project. We reject generalized estimates in favor of a detailed, facility-specific investment analysis. The core data inputs include:

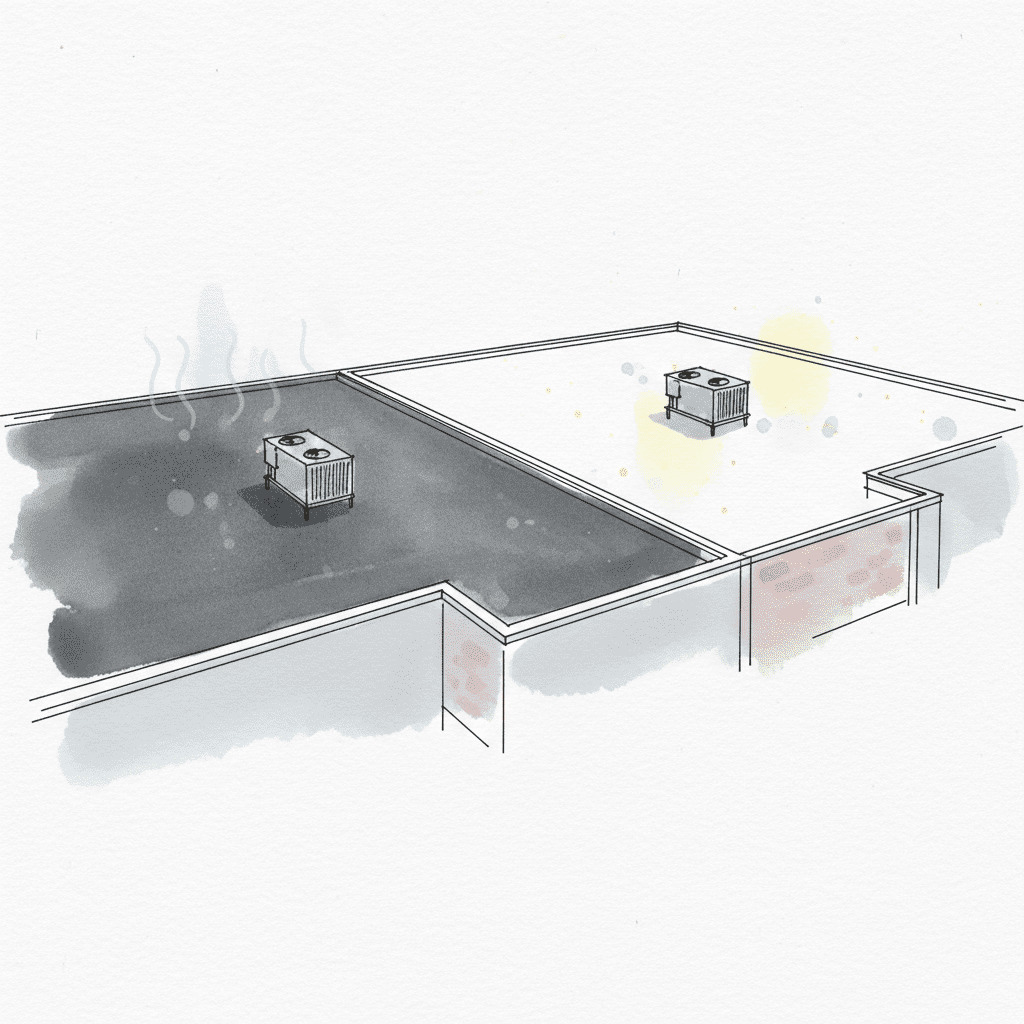

Facility-Specific Variables: Roof Area, Insulation (R-Value), and Existing Assembly

The thermal performance of your building envelope is the baseline for any calculation. We conduct a thorough analysis of the existing roof assembly, including the total square footage, the type and condition of the current membrane, and, most importantly, the effective thermal resistance (R-value) of the insulation. A poorly insulated roof will see a more dramatic financial benefit from a cool roof system, a variable that must be accurately modeled.

Geographic & Climate Data: Degree Days, Solar Irradiance, and Utility Rate Structures

Energy savings are geographically dependent. Our models incorporate your facility’s specific climate zone, including local cooling degree days (CDD) and solar irradiance data. Crucially, we analyze your specific utility provider’s rate structure, identifying the precise cost per kWh and the methodology for calculating peak demand charges. This transforms a generic energy savings estimate into a projection grounded in your actual financial environment.

Material & Installation Cost Analysis: TPO, PVC, Modified Bitumen, and Coatings

The selection of material is a financial decision. Each system presents a different profile of initial cost, expected service life, and performance metrics. We provide a transparent comparison to inform your capital allocation strategy.

| System Type | Initial SRI Value (Typical) | Expected Lifespan | Primary Financial Driver |

|---|---|---|---|

| White TPO (60-mil) | 100 – 104 | 15-25 Years | Excellent balance of cost, longevity, and high reflectivity. |

| White PVC (60-mil) | 103 – 108 | 20-30 Years | Superior chemical/grease resistance for industrial/restaurant facilities. |

| Acrylic/Silicone Coating | 105 – 110 | 10-15 Years (before recoat) | Lower initial CapEx to restore and upgrade an existing, viable roof substrate. |

| Conventional EPDM (Black) | ~6 | 20-30 Years | High durability, but serves as a heat sink, increasing energy OpEx. |

Factoring in Rebates, Tax Credits, and Government Incentive Programs

The final component of our ROI model is the inclusion of all available financial incentives. This includes utility rebates for energy-efficient upgrades, federal tax credits, and accelerated depreciation schedules under provisions like Section 179. These programs can significantly reduce the net capital outlay and shorten the payback period, and our process ensures these opportunities are identified and integrated into the project’s financial justification.

Modeling Financial Returns: Projecting Payback Period and Net Present Value

Once the data is compiled, our analysis shifts to producing clear, investment-grade financial projections. We translate engineering specifications into the language of the CFO, demonstrating the project’s value through standard financial metrics that support your CapEx approval process.

Calculating Annual Energy Savings and Reduced Peak Load Charges

Using industry-standard energy modeling software, we project the annual reduction in kilowatt-hour (kWh) consumption directly attributable to the new cool roof system. More importantly, we model the impact on peak load, quantifying the savings from mitigated demand charges. This provides a clear, defensible projection of annual operational savings—the core cash flow that will pay back the initial investment.

Determining Simple Payback, IRR, and NPV for CapEx Justification

We present the financial returns in three standard formats:

- Simple Payback Period: The time required for the accumulated energy savings to equal the initial investment.

- Internal Rate of Return (IRR): The annualized rate of return generated by the project, allowing you to compare this investment against other capital allocation opportunities.

- Net Present Value (NPV): Calculates the total value of the investment in today’s dollars by discounting future energy savings. A positive NPV indicates a financially sound project.

Extended Asset Lifespan: Quantifying the Value of Reduced Thermal Stress

A significant, often overlooked, financial return is the extension of the roofing asset’s own lifespan. A cool roof can experience temperature swings of 50-70°F less than a dark roof on a summer day. This drastic reduction in thermal shock minimizes membrane degradation, reduces the stress on seams and flashings, and ultimately defers the need for future capital replacement. This is a direct act of capital preservation.

Risk Mitigation Analysis: Non-Monetary Returns and Liability Reduction

Beyond direct financial ROI, a cool roof installation is a powerful tool for risk management. It addresses regulatory, environmental, and operational liabilities that carry significant, if less direct, financial implications.

Compliance with Building Codes and Energy Efficiency Standards (ASHRAE 90.1)

Energy codes, such as ASHRAE 90.1 and California’s Title 24, are becoming increasingly stringent. Installing a compliant cool roof is not just good practice; it is a required standard in many jurisdictions for new construction and major renovations. Proactive compliance de-risks your asset from potential fines, mandated retrofits, and delays in permitting, ensuring your facility remains a marketable and compliant asset.

Contribution to ESG Mandates and Corporate Sustainability Reporting

For organizations with public-facing ESG (Environmental, Social, Governance) goals, a cool roof provides a tangible, reportable achievement. It measurably reduces the building’s carbon footprint, contributes to LEED certification points, and serves as a visible commitment to corporate responsibility—a factor of growing importance to investors, tenants, and customers.

Enhancing Tenant Comfort to Reduce Occupancy Disruption and Turnover

In facilities with occupants directly under the roof deck, a cool roof significantly improves thermal comfort. This reduces employee or tenant complaints, improves productivity, and can be a key factor in tenant retention. Stable occupancy is the bedrock of asset profitability, and investing in the physical comfort of the space is a direct investment in lease value.

Executing for Fiscal Certainty: The RocStout Capital Planning Protocol

A correct diagnosis and a sound financial model are meaningless without flawless execution. The greatest threat to any capital project’s ROI is operational disruption. The standard commercial contractor creates delays, safety hazards, and tenant issues that erode project value. RocStout’s methodology is engineered to eliminate these risks and deliver fiscal certainty.

Line-Item Scoping and ‘No Surprise’ Billing for Predictable Capital Expenditure

Our proposals are not estimates; they are precise statements of work. Every material, labor component, and logistical requirement is detailed, providing you with absolute budgetary accuracy. This financial control is central to our role as your fiduciary partner, protecting your capital from the budget overruns common in the industry.

Standard Operating Procedures for Minimizing Tenant and Operational Disruption

We understand that time is money. Our project management protocol is built around one central goal: preserving your operational continuity. This includes pre-project tenant communication plans, clearly defined site logistics for material staging and debris removal, and rigid adherence to safety protocols. Our presence on your property is professional, clean, and engineered to be invisible to your core business functions.

Integrating Roof Installation into a Multi-Year Asset Management Plan

The installation of a new roof is the beginning of its lifecycle, not the end of the project. We deliver a complete asset, including all warranty documentation and a schedule for proactive maintenance. This transitions your roof from a reactive liability to a managed asset, ensuring it delivers its projected financial performance for its entire service life. This is the only responsible methodology for managing commercial infrastructure.