Deconstructing Total Cost of Ownership: A Framework for Capital Asset Planning

The Total Cost of Ownership (TCO) for a commercial roof is a financial modeling framework used by fiduciaries to calculate the full economic impact of a roofing asset over its entire service life, moving beyond the initial installation price to include all operational, maintenance, and end-of-life expenditures. For the CFO or Facility Manager, this is not a contractor’s quote; it is a capital planning tool designed to forecast liability and maximize the return on a multi-decade asset.

Initial Capital Outlay (CapEx): A Forensic Analysis Beyond the Bid Price

Treating the initial project cost as the sole decision driver is a critical financial error. The lowest bid is often a direct indicator of compromised material specifications, inadequate substrate preparation, and underestimated disposal costs—liabilities that will manifest as future operational disruptions and premature capital expenditures. A responsible CapEx analysis must be forensic, scrutinizing every line item as a component of long-term asset performance.

- Substrate Preparation: Failure to properly address compromised decking, wet insulation, or inadequate fasting patterns is the primary cause of premature system failure. A low bid often signals a dangerous ‘overlay’ approach, which merely conceals underlying defects and transfers liability to you, the asset owner.

- Material Specifications: The specified membrane thickness, fastening pattern, and seam technology directly correlate to puncture resistance, wind uplift ratings, and overall lifespan. We engineer specifications to meet or exceed code, mitigating risk from extreme weather events and protecting your insurance eligibility.

- Labor and Compliance: A significant portion of a responsible bid accounts for certified, insured labor and strict adherence to OSHA safety protocols. Bids that undervalue labor are a red flag for uninsured subcontractors, inadequate safety measures, and potential worksite liabilities that will ultimately fall on the property owner.

- Tear-Off and Disposal: Environmental regulations for material disposal are stringent and carry significant financial penalties. A thorough CapEx plan includes the documented, compliant disposal of all roofing materials, protecting your organization from regulatory action.

Operational Expenditures (OpEx): Quantifying Long-Term Financial Liabilities

Once installed, the roof transitions from a capital project to an operational liability. Managing this OpEx profile determines the asset’s true cost. Unplanned repairs, energy loss, and tenant disruptions are not acceptable costs of doing business; they are symptoms of a failed initial strategy.

- Proactive Maintenance: A scheduled, semi-annual inspection and maintenance program is the most effective tool for converting unpredictable emergency repairs into a modest, predictable operational expense. This includes debris removal, drain inspection, and seam integrity verification.

- Energy Efficiency: The R-value of your insulation and the reflectivity of your roof membrane are direct inputs into your building’s energy consumption. A properly engineered roof system reduces HVAC load, generating a quantifiable ROI through lower utility costs year after year.

- Insurance Premiums: A well-documented, professionally maintained roof with high wind uplift and impact ratings can directly reduce property insurance premiums. Conversely, an aging or poorly maintained roof is a primary driver of increased premiums or even policy cancellation.

End-of-Life Costs: Planning for Asset Decommissioning and Replacement

A roofing asset does not simply expire; it must be decommissioned in compliance with then-current building codes and environmental regulations. A fiduciary approach to TCO includes planning for this final phase from day one, establishing a capital reserve to ensure the asset’s replacement does not become a financial emergency.

- Asset Decommissioning and Disposal: The cost to tear off and legally dispose of a 20,000-square-foot roof system is a significant future liability. This must be factored into the lifecycle cost model.

- Code Compliance Updates: Building codes, particularly regarding insulation R-values and wind uplift requirements, evolve. The roof you install today must be replaced with a system that meets the codes of tomorrow, often at a higher cost. A proper TCO model anticipates this escalation.

- Capital Reserve Planning: We work with asset managers to establish a multi-year capital reserve schedule. By allocating a predictable annual amount, you smooth the financial impact of a full replacement, preserving capital for other strategic investments.

Critical TCO Variables: A Quantitative Risk and Performance Assessment

Effective financial modeling of your roofing asset depends on a precise understanding of key performance variables. These technical specifications are not contractor preferences; they are financial inputs that dictate long-term durability, operational costs, and liability exposure. Our methodology is to translate material science into a clear risk and performance assessment for your specific asset.

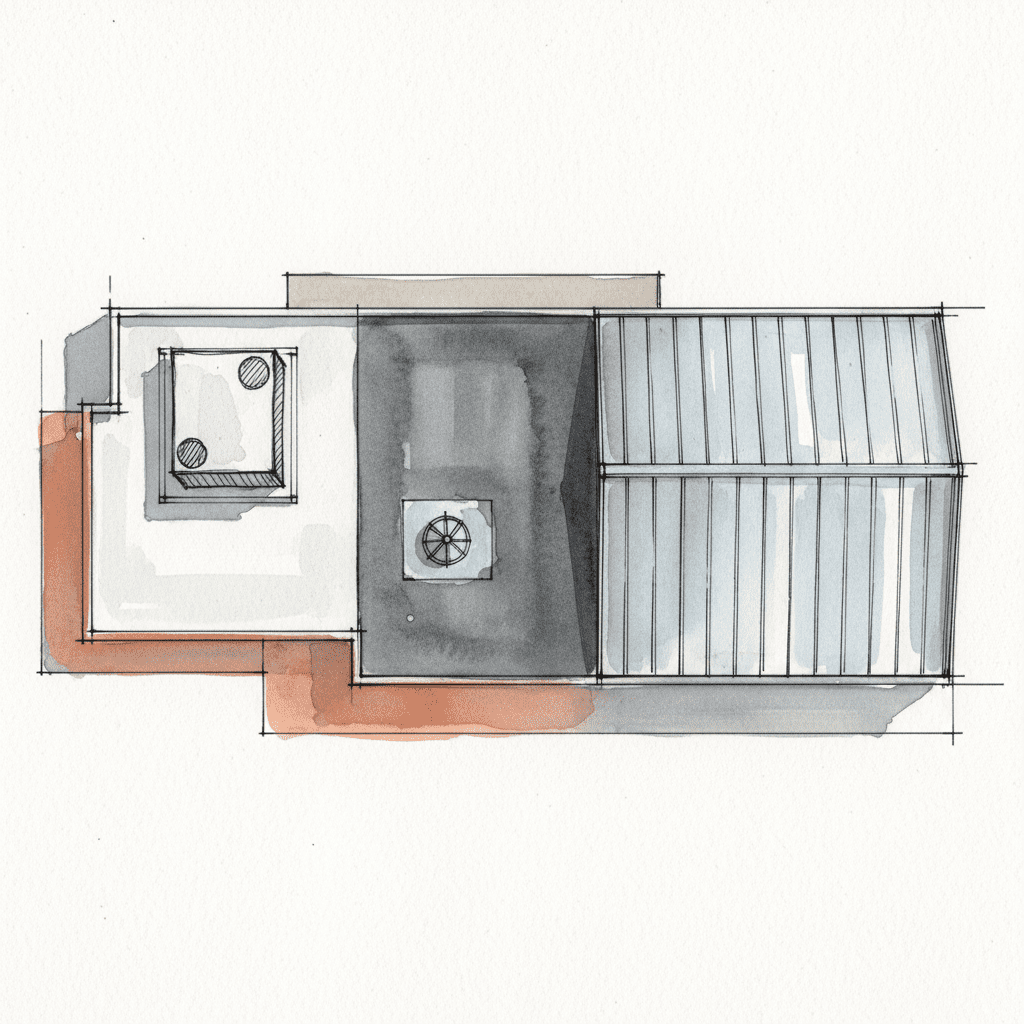

Roof System Selection: Impact on Long-Term Financial Performance and Durability

The choice of roofing membrane is a long-term investment decision. Each system offers a different profile of durability, chemical resistance, and energy performance, directly impacting your TCO.

- TPO (Thermoplastic Polyolefin): A preferred system for its high solar reflectivity (albedo), which significantly lowers cooling costs in applicable climate zones. Its heat-welded seams provide superior, monolithic protection against water ingress compared to glued or taped EPDM seams.

- PVC (Polyvinyl Chloride): Valued for its exceptional resistance to chemicals, greases, and fire. PVC is a standard specification for restaurants, manufacturing facilities, and buildings with high levels of rooftop exhaust, as it mitigates the risk of premature membrane degradation.

- EPDM (Ethylene Propylene Diene Monomer): A durable synthetic rubber membrane with a proven track record. However, its traditionally black surface absorbs heat, increasing energy OpEx. Furthermore, its reliance on adhesives for seam integrity presents a higher long-term risk of failure compared to welded TPO or PVC seams.

Insulation and R-Value: Calculating Energy Cost Reduction and Payback Period

Insulation is not an optional upgrade; it is a performance component with a measurable payback period. The thermal resistance, or R-value, of your roof system dictates the amount of energy required to heat and cool your facility. A higher R-value directly translates to lower operational expenditures.

Our process includes a comprehensive energy audit to calculate the optimal R-value based on your climate zone, building use, and local energy costs. We model the projected utility savings against the initial investment in higher-performance polyisocyanurate (polyiso) insulation, providing a clear timeline for achieving ROI. This analysis often uncovers eligibility for utility rebates and tax incentives, further reducing the net capital outlay.

Warranty Analysis: Differentiating Manufacturer Liability from Contractor Accountability

A manufacturer’s warranty is one of the most misunderstood documents in commercial real estate. It is not an all-inclusive insurance policy. The vast majority of roof failures—over 90%—are due to contractor workmanship, not material defects. A fiduciary must understand the clear and critical distinction between manufacturer liability and contractor accountability. Choosing a contractor based on the length of the manufacturer’s warranty is a flawed, high-risk strategy.

| Warranty Type | Coverage Scope | Common Exclusions | Fiduciary Implication |

|---|---|---|---|

| Manufacturer NDL Warranty | Covers defects in the roofing materials themselves. | Installation errors, ponding water, unauthorized alterations, lack of maintenance. | Provides false security. The manufacturer is only liable for the material, not the leaks caused by poor installation—the most common point of failure. |

| Contractor Workmanship Guarantee | Covers defects in the installation process (seams, flashings, penetrations). | Dependent on the contractor’s financial stability and integrity. | This is your primary protection against leaks and operational disruption. The quality and longevity of the contractor are more critical than the warranty document itself. |

The Financial Impact of Installation Protocols on Asset Lifespan and Liability

The long-term performance and TCO of a roofing asset are determined not on the day the materials are delivered, but during every hour of the installation process. Standard industry workmanship is the single greatest threat to your capital investment. We reject this standard in favor of rigid, engineered installation protocols designed to eliminate liability and guarantee performance. This is not just construction; it is the execution of a risk management strategy.

Seam Integrity Analysis: Mitigating Water Ingress and Inventory Loss

A commercial roof is not a single entity; it is a system of membranes joined at seams. These seams represent the system’s most vulnerable point. Adhesion failures, common with EPDM systems or improperly installed TPO, create direct pathways for water ingress. A single failed seam can lead to catastrophic inventory loss, damage to interior structures, and tenant disputes. Our standard operating procedure mandates automated heat-welding for all thermoplastic seams, creating a monolithic, watertight bond that is stronger than the membrane itself. This engineering detail eliminates the primary vector for business interruption.

Drainage Engineering: Preventing Premature Degradation and Code Violations

Ponding water is an unambiguous sign of system failure and a direct violation of building codes. It is also a significant financial liability. The weight of standing water exceeds the structural load calculations for most roof decks, accelerating material degradation and voiding manufacturer warranties. We perform a complete hydraulic analysis of every roof surface, engineering a tapered insulation system that guarantees positive drainage. This proactive engineering prevents the premature material failure, structural overload, and code violations that are endemic to low-bid installations.

Project Management: Minimizing Operational Disruption and Tenant Impact

The true cost of a roofing project must include the financial impact of operational disruption. Noise, debris, safety hazards, and poor communication can damage tenant relationships and impact your core business. Our project management protocol is built around one central objective: ensuring your operational continuity. We view the project site not as a construction zone, but as your active place of business.

Proactive Maintenance vs. Reactive Repair: A Lifecycle Cost Comparison

The industry standard of reactive repair—waiting for a leak to occur before taking action—is the most expensive and high-risk method of managing a roofing asset. It guarantees operational disruption, higher repair costs, and accelerated asset degradation. As your fiduciary partner, we operate under a proactive asset preservation model, a strategy designed to maximize lifespan and deliver predictable, manageable costs.

Developing a Multi-Year Maintenance Budget: A CapEx Smoothing Strategy

A Roof Asset Management Plan is a strategic document that provides fiscal certainty. It begins with a comprehensive condition assessment, often utilizing non-destructive methods like infrared thermography to identify subsurface moisture without penetrating the membrane. Based on this data, we develop a multi-year maintenance schedule and budget. This proactive approach transforms unpredictable, high-cost emergency calls into a planned, modest OpEx line item, allowing for accurate capital budget forecasting and eliminating financial surprises.

The Compounding Cost of Deferred Maintenance: A Case Study in Asset Devaluation

Deferring roof maintenance is not a cost-saving measure; it is the accrual of a high-interest debt against your asset. A minor puncture, if ignored, allows moisture to saturate insulation, reducing R-value and creating a vector for mold. Saturated insulation then degrades the roof deck, turning a simple repair into a significant structural project. This cascade of failure has severe financial consequences:

- Catastrophic Failure: The endpoint of deferred maintenance is a system failure that causes significant business interruption and inventory loss.

- Asset Devaluation: A poorly maintained roof is a major red flag during a property condition assessment, directly lowering the building’s market value and complicating sale or refinancing.

- Increased Insurance Liability: Documented neglect of a roofing asset can be grounds for an insurance provider to deny a claim related to water damage or wind uplift failure.

The RocStout Methodology: Engineering Fiscal Certainty in Roof Asset Management

We operate as fiduciary advisors, not conventional contractors. Our entire methodology is engineered to provide fiscal certainty and protect your operational continuity. We do not compete on the initial bid price; we compete on delivering the lowest Total Cost of Ownership. This is achieved through a non-negotiable commitment to financial transparency and rigorous, process-driven execution.

Line-Item Reporting and “No Surprise” Billing: Your Partner in Capital Planning

Ambiguity is a profit center for the average contractor. Our process eliminates it. You receive a detailed, line-item proposal that serves as a clear statement of work and a precise budget document. Any potential change order is governed by a strict protocol requiring written pre-approval, ensuring there are no surprises on the final invoice. This financial transparency makes us a reliable partner in your capital expenditure planning and budget reconciliation process.

Rigorous SOPs and OSHA Compliance: Ensuring Operational Continuity and Safety

Our Standard Operating Procedures (SOPs) are the core of our risk management promise. Every action on your property, from material loading to seam welding to site cleanup, is governed by a documented, safety-compliant process. Our unwavering adherence to OSHA regulations is not just about compliance; it is about shielding your organization from the significant legal and financial liabilities of a worksite accident. By institutionalizing excellence, we remove the variables that create risk, delivering a predictable, safe, and professional project that protects your most valuable asset: your ability to operate your business without disruption.