Leak liability in commercial real estate is not a maintenance issue; it is a cascading financial event that directly erodes asset value and introduces unforecasted risk into capital expenditure (CapEx) planning. For the fiduciary asset manager, property owner, or CFO, viewing a roof leak as a simple repair is a fundamental miscalculation. It represents a breach in the building envelope that triggers a predictable chain of financial, legal, and operational consequences. The industry-standard practice of ‘patching’—applying a temporary, low-cost fix to defer a capital expense—is the single most common catalyst for these consequences. This reactive approach systematically ignores underlying system failures, masks latent defects, and ultimately destroys the fiscal certainty required for responsible asset management. It is a strategy that prioritizes short-term OpEx savings at the direct expense of long-term asset value and operational stability.

Defining the Chain of Liability: Owner, Tenant, and Contractor Obligations

Understanding where liability begins and ends is not a legal abstraction; it is a core component of risk management. When water enters a commercial facility, the financial responsibility is allocated based on a complex interplay of legal duties, contractual agreements, and professional standards. Ignoring this chain of liability exposes the asset owner to significant financial and legal peril, turning a manageable maintenance item into a source of protracted litigation and financial loss.

Property Owner’s Fiduciary Duty and Premises Liability

The legal foundation of an owner’s responsibility is the doctrine of premises liability. This doctrine imposes a fiduciary duty upon the property owner to maintain the asset in a reasonably safe condition to prevent foreseeable harm to tenants, employees, and customers. The building envelope, with the roof as its primary shield, is central to this duty of care. A failure to proactively maintain the roof system is not merely a poor business decision; it can be legally interpreted as negligence. Due diligence in this context is an active, documented process. It requires regular inspections, adherence to manufacturer maintenance guidelines, and timely repairs executed to professional standards. When a leak occurs and causes damage, the first question in any legal proceeding will be: ‘What did the owner do to prevent this?’ A record of deferred maintenance or opting for cheap, inadequate patches provides a clear and damaging answer, shifting liability squarely onto the owner.

Analyzing Tenant Responsibilities Under Commercial Lease Structures (NNN, MG)

Commercial lease agreements, particularly Triple Net (NNN) leases, are often misinterpreted as a complete transfer of maintenance responsibility to the tenant. While a NNN lease typically obligates the lessee to cover maintenance, taxes, and insurance, this rarely absolves the lessor of liability for the structural integrity of the building, including the roof. The specific language of the maintenance clause is critical. Most well-drafted leases distinguish between routine maintenance (e.g., clearing drains, minor repairs), which falls to the tenant, and capital replacement or repair of structural components, which remains the owner’s obligation. A landlord who knowingly allows a tenant to perform substandard ‘patches’ on a failing roof system, even under a NNN lease, can still be found negligent. The owner retains a non-delegable duty to ensure the entire asset is structurally sound. Misunderstanding these repair obligations creates a false sense of security and exposes the owner to disputes, claims of constructive eviction, and liability for the tenant’s business interruption losses.

Contractor Warranties vs. Manufacturer Specifications: Navigating Coverage Gaps

A significant source of financial risk lies in the gap between a contractor’s workmanship warranty and a manufacturer’s material warranty. The typical contractor warranty is limited, often lasting only one to two years, and covers only failures directly attributable to their installation labor. It explicitly excludes consequential damages—the catastrophic financial losses from damaged inventory, ruined equipment, and tenant displacement. Conversely, a manufacturer’s warranty covers defects in the roofing materials themselves, but it is contingent upon the system being installed precisely to manufacturer specifications by a certified applicator. Choosing the lowest-bid contractor often means they cut corners, violating these specifications and voiding the manufacturer’s warranty from day one. This leaves the asset owner with a worthless material warranty and a short-term, limited workmanship warranty, creating a massive coverage gap and exposing the asset to the full financial impact of a system failure.

Quantifying the Financial Impact of Unmitigated Water Ingress

The cost of a roof leak is never confined to the price of the repair. For the asset manager, the true financial impact is a multi-layered event that degrades the building’s structural integrity, disrupts revenue-generating operations, and complicates insurance and liability profiles. Treating water intrusion as a minor operational expense, rather than a direct threat to the balance sheet, is a critical error in capital planning.

Direct Costs Analysis: Structural Damage, Inventory Loss, and Mold Remediation

The most immediate and visible costs of water ingress are direct capital expenditures. Water saturating roof insulation renders it thermally useless, immediately increasing HVAC energy consumption. More critically, it accelerates the corrosion of steel roof decks and fasteners, compromising the building’s structural integrity. This damage is often hidden, progressing undetected until a catastrophic failure occurs. Below the deck, the financial damage escalates. For tenants in warehousing, manufacturing, or retail, a single leak can result in hundreds of thousands of dollars in inventory loss. Beyond physical goods, water intrusion creates the ideal environment for mold growth, which is not merely a cleaning issue but a significant health hazard requiring specialized, expensive mold remediation protocols. These are not minor operational costs; they are unplanned capital expenditures that decimate maintenance budgets and erode profitability.

Indirect & Consequential Damages: Tenant Displacement and Lost Revenue

The indirect costs of a roof failure often dwarf the direct repair expenses. A persistent leak can render a tenant’s space unusable, triggering clauses for rent abatement or, in severe cases, lease termination. The loss of a key tenant not only impacts immediate cash flow but also degrades the property’s valuation and attractiveness to future lessees. For the tenant, the cost of business interruption—lost sales, idle employees, and supply chain disruptions—can be crippling. While they may have business interruption insurance, their insurer will often seek to recover those losses from the party deemed negligent: the property owner. This leads to litigation, tenant concessions to prevent legal action, and significant reputational risk that can make it difficult to retain or attract high-value tenants in the future.

| Cost Category | Description of Financial Impact | Budgetary Classification |

|---|---|---|

| Direct Structural Damage | Corrosion of steel deck, saturated insulation (R-value loss), damage to structural members. | Unplanned Capital Expenditure (CapEx) |

| Interior Asset Damage | Destruction of tenant inventory, equipment, and tenant improvements (TIs). | Liability / Direct Loss |

| Mold Remediation | Specialized environmental cleanup required to address health hazards and liability. | Emergency Operating Expense (OpEx) |

| Business Interruption | Tenant revenue loss due to operational shutdown, leading to rent abatement claims. | Revenue Loss / Contingent Liability |

| Reputational Damage | Difficulty attracting/retaining tenants; perceived as a poorly managed asset. | Asset Devaluation |

| Increased Insurance Premiums | Higher premiums following claims, or potential non-renewal for high-risk properties. | Increased Operating Expense (OpEx) |

Navigating Commercial Property Insurance: Exclusions, Claims, and Premium Impact

Asset managers often operate under the false assumption that their commercial property insurance will cover leak-related damages. This is a dangerous oversimplification. Standard policies are designed to cover sudden and accidental events, often termed ‘Acts of God.’ They almost universally contain a policy exclusion for damage resulting from gradual deterioration, wear and tear, or a failure to perform routine maintenance. An insurance adjuster’s first step is to investigate the cause of the leak. If their investigation reveals a history of deferred maintenance, ignored deficiencies, or cheap patches instead of proper repairs, the claim will likely be denied, leaving the owner responsible for the entire loss. Furthermore, even if a claim is paid, it can trigger a significant increase in future premiums or even non-renewal of the policy. Proper documentation, including regular inspection reports and maintenance logs, is the only effective tool to navigate the claims process and prove that the damage was not the result of negligence.

The Role of Building Codes and Safety Regulations in Liability Cases

In the context of litigation, compliance with building codes and safety regulations is not optional; it is the minimum acceptable standard of care. A failure to adhere to these mandates provides opposing counsel with a powerful, often irrefutable, argument of negligence. For the asset manager, this transforms regulatory compliance from a bureaucratic hurdle into a critical component of legal and financial risk mitigation.

Code Violations as Prima Facie Evidence of Negligence

When a roof system fails, the subsequent investigation will benchmark the installation against the prevailing International Building Code (IBC) and local amendments. Violations related to improper roof drainage, inadequate wind uplift rating for the geographic zone, or the use of non-compliant materials are not mere technicalities. In a courtroom, they are treated as *prima facie* evidence of negligence—meaning the act itself is sufficient to prove a breach of duty. This drastically simplifies the plaintiff’s case. They no longer need to prove you were careless; they only need to prove the code violation occurred and that it was a contributing factor to their damages. This is why selecting a contractor based on the lowest bid is so perilous; such contractors often achieve low pricing by omitting crucial, code-required components, thereby embedding liability directly into the asset.

OSHA Safety Protocols: Mitigating On-Site Contractor Accident Liability

An owner’s liability extends beyond the performance of the roof to the conduct of the contractors on their property. The Occupational Safety and Health Administration (OSHA) enforces strict safety protocols for the construction industry, particularly concerning fall protection. If a contractor’s employee is injured on-site due to a safety violation, the property owner can be named as a defendant in the ensuing lawsuit under the principle of general contractor liability. Vetting a roofing partner’s safety record is therefore a non-negotiable step in risk management. This includes verifying their Experience Modification Rate (EMR)—an insurance industry benchmark of past safety performance—and demanding a site-specific safety plan that demonstrates rigorous OSHA compliance. A partner with a culture of safety protects not only their workers but also the asset owner from devastating third-party liability claims.

The Criticality of Maintenance Logs and Inspection Reports in Legal Defense

In the event of a liability claim, the legal discovery process will demand a complete history of the asset’s maintenance. A well-maintained file of inspection reports, maintenance records, and repair invoices serves as the owner’s primary legal shield. This documentation creates a clear chain of custody, demonstrating a consistent pattern of due diligence and proactive care. It proves that the owner took reasonable steps to identify and rectify potential issues, forming a powerful defense against claims of negligence. Conversely, the absence of such records creates a negative inference. It suggests a reactive, neglectful approach to asset management, making it far easier for a plaintiff to argue that the owner failed in their fiduciary duty to maintain a safe premises.

Forensic Leak Diagnostics: Pinpointing Technical Failures and Legal Culpability

When a leak occurs, the immediate priority is to stop the water. The fiduciary priority, however, is to scientifically determine the precise point of failure and the root cause. Forensic leak diagnostics replace guesswork with engineering, providing the objective data required to assign legal culpability, validate insurance claims, and develop a permanent, fiscally responsible solution. This process is the antithesis of ‘patching,’ which only addresses the symptom while allowing the underlying liability to grow.

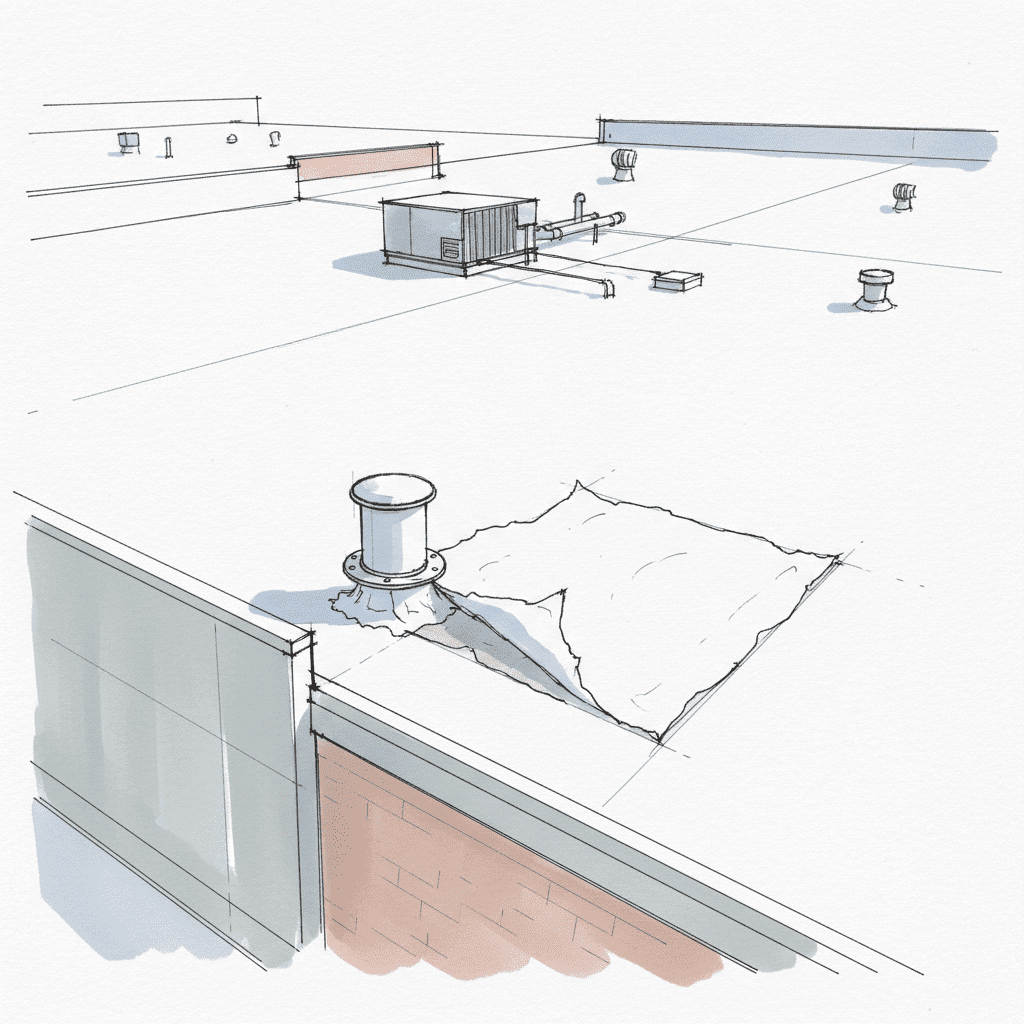

Common Failure Points in Commercial Systems (TPO, EPDM, Modified Bitumen)

Every commercial roofing system has inherent vulnerabilities that are exacerbated by improper installation or deferred maintenance. In single-ply systems like Thermoplastic Olefin (TPO) and EPDM, the most common failure points are seams and flashing details. Poorly welded TPO seams or failed EPDM seam adhesive allow for immediate water intrusion. Similarly, improperly detailed flashings at curbs, pipes, and wall transitions are responsible for a majority of leaks. For multi-ply systems like modified bitumen, issues such as open laps, blistering, and membrane cracking are clear indicators of system degradation or installation error. Identifying these specific failure points is crucial, as it allows for the differentiation between workmanship errors (contractor liability), material defects (manufacturer liability), and end-of-life wear (owner responsibility).

Leveraging Infrared Thermography for Non-Destructive Moisture Verification

One of the greatest hidden liabilities in a commercial roof is saturated insulation. Wet insulation provides no thermal resistance (R-value), driving up energy costs, and acts as a reservoir that promotes deck corrosion. Infrared (IR) thermography is a non-destructive testing method that provides definitive proof of this subsurface moisture. An IR survey, typically performed after sunset, reveals areas of wet insulation, which retain heat longer than dry materials. The resulting thermal image is an objective map of the roof’s compromised areas. This data is invaluable for three reasons: it quantifies the full scope of the damage for an insurance claim, it prevents contractors from recommending a full tear-off when only a partial replacement is needed, and it provides the evidence to reject an ‘overlay’—a new membrane installed over wet, damaged substrate, which is a grossly negligent practice that masks a severe structural liability.

Differentiating Latent Defects, Storm Damage, and Negligent Maintenance

The financial and legal path forward is determined by the cause of failure. A forensic analysis provides the data to make this critical differentiation. A latent defect, such as improper material formulation by the manufacturer, points liability back to the source of the product. Storm damage, like hail impacts or wind scour from a specific, documented weather event, triggers an insurance claim. However, if the analysis shows clogged drains, widespread membrane deterioration due to UV exposure, and seams that have failed due to age and lack of maintenance, the cause is clearly negligent maintenance. This places the financial responsibility squarely on the owner. Without a scientific, data-driven process of causation, owners often mistakenly file insurance claims for maintenance issues (inviting denial) or blame contractors for issues that are the result of their own deferred upkeep.

Proactive Liability Mitigation: A Framework for Capital Asset Preservation

The only way to control leak liability is to shift from a reactive repair model to a proactive framework of asset preservation. This approach treats the roof not as a potential problem but as a critical financial asset with a predictable lifecycle. It requires a strategic pivot from unpredictable operational expenditures to planned, data-driven capital forecasting. This is the foundation of responsible fiduciary management.

Implementing a Scheduled Roof Asset Management (RAM) Program

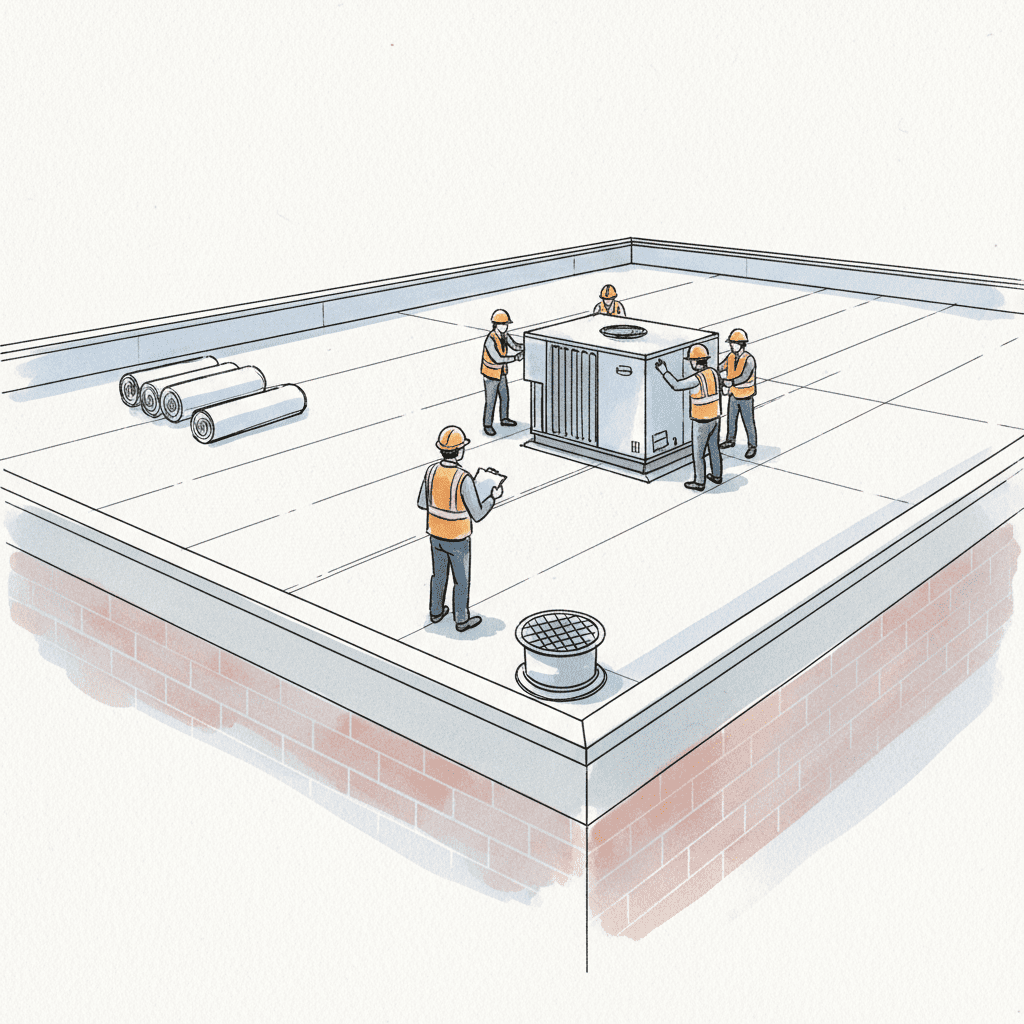

A Roof Asset Management (RAM) program is the standard operating procedure for any professionally managed commercial property. It formalizes the owner’s commitment to due diligence through a schedule of regular, documented inspections and preventive maintenance. A typical RAM program includes semi-annual inspections to assess membrane condition, check flashing integrity, and clear drains and gutters of debris. This proactive approach allows for minor issues to be addressed at a low cost before they can escalate into catastrophic failures. Crucially, it generates the continuous stream of documentation—inspection reports, photos, and maintenance logs—that serves as your primary evidence of due diligence in any legal or insurance dispute, maximizing the asset’s lifecycle and ROI.

Transitioning from Reactive Repair Budgets to Predictable CapEx Forecasting

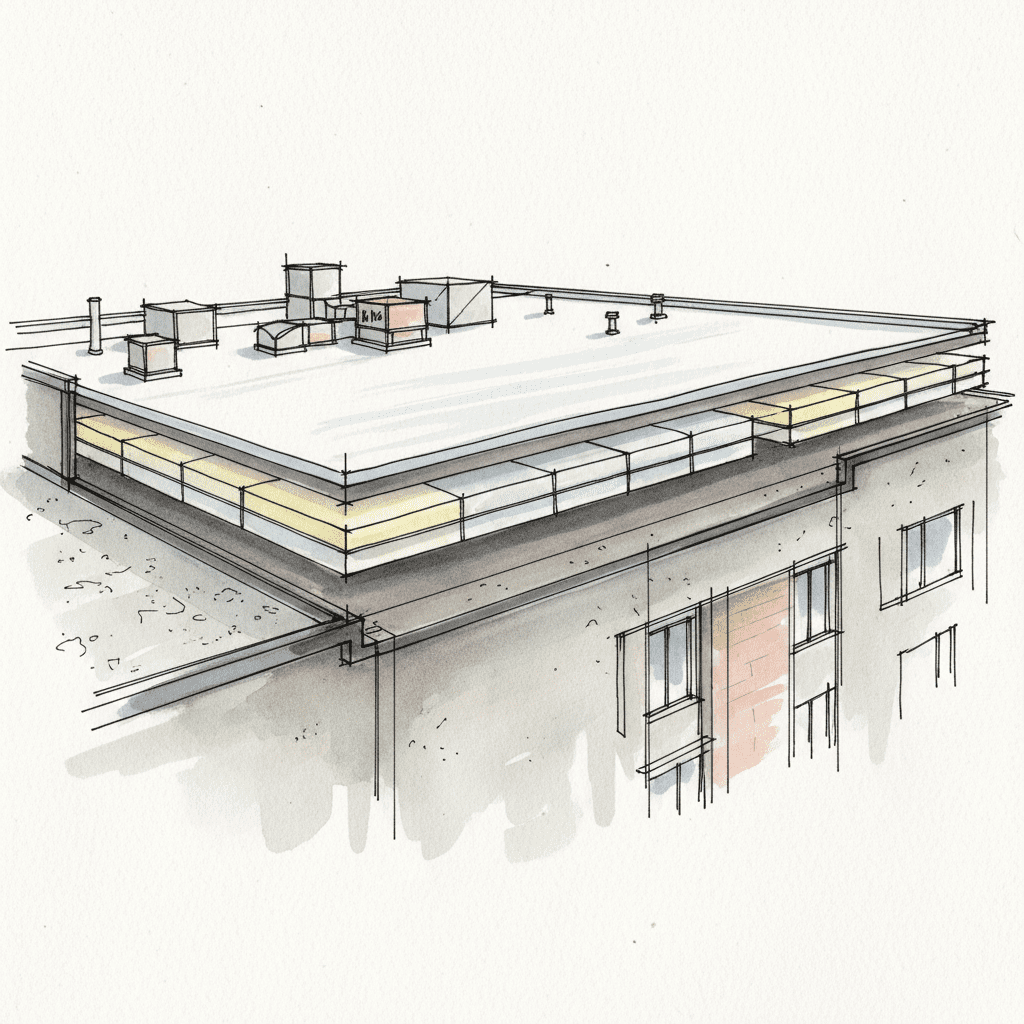

The ‘patch it when it leaks’ model creates extreme budget volatility. Emergency repairs are always more expensive, disrupt tenants, and drain operational budgets (OpEx) without adding any long-term value to the asset. A proactive approach, grounded in a RAM program, provides the data needed for accurate CapEx forecasting. Through condition assessments and core analysis, a qualified consultant can project the roof’s remaining service life and develop a multi-year capital plan for its eventual replacement. This transforms a potential financial emergency into a predictable, budgeted line item. It gives the CFO and asset manager fiscal certainty, allowing for the strategic allocation of capital rather than the constant, panicked reaction to failure.

Vetting Commercial Roofing Contractors: A Risk Management Imperative

Choosing a roofing contractor is one of the most significant risk management decisions an asset manager will make. The industry is saturated with low-bid contractors whose business model depends on cutting corners that are invisible to the untrained eye. Selecting a partner based on price alone is a direct invitation to liability. A rigorous vetting process is imperative. This must include verification of adequate general liability and errors and omissions (E&O) insurance, a review of their financial stability to ensure they can stand behind their warranty, and an analysis of their safety record (EMR). The lowest bid is often a signal of inadequate insurance, undertrained labor, and a disregard for safety and manufacturer specifications—a combination of factors that transfers risk directly from the contractor to you, the asset owner.

The RocStout Protocol: Engineering Certainty in Roof Asset Management

At RocStout, we operate as fiduciary partners, not contractors. Our entire methodology is engineered to eliminate the operational, financial, and legal risks that define the commercial roofing industry. We reject reactive repair and the ‘lowest bid’ mentality in favor of a process-driven protocol that delivers fiscal certainty and protects asset value. Our standard operating procedures are designed for the asset manager who understands that operational continuity is non-negotiable.

Our SOP for Zero-Disruption Project Execution and Tenant Relations

The true enemy of any asset manager is operational disruption. A roofing project that disrupts tenants, creates safety hazards, or interferes with site logistics is a financial failure, regardless of the technical quality. Our protocol begins with a comprehensive logistics and communication plan. We meet with facility management and tenant representatives before a single tool arrives on-site to coordinate schedules, parking, material staging, and noise-sensitive operations. Daily progress reports and a dedicated project manager ensure all stakeholders are informed, and our ‘water-tight-by-nightfall’ policy is a rigid mandate on every project. We manage the project to ensure your business operations continue without interruption.

Line-Item Reporting and ‘No Surprise’ Billing for Predictable Expenditures

Fiscal certainty is the core of our value proposition. Our proposals are not vague estimates; they are detailed, line-item reports that provide complete transparency into material costs, labor, and project management. This allows for an apples-to-apples comparison and a clear understanding of the investment. Once a project is underway, our change order management process is exceptionally rigorous. No additional work is ever performed without a formal, pre-approved change order that details the scope and cost. This ‘No Surprise’ billing philosophy eliminates the budget overruns that are common in the industry and provides the predictable expenditure that CFOs and capital planners require.

Comprehensive Lifecycle Partnership: From Initial Audit to Multi-Year CapEx Strategy

Our engagement is not transactional; it is a long-term partnership in asset preservation. It begins with a comprehensive forensic audit to establish a baseline of your roof’s condition, identify existing liabilities, and quantify any subsurface moisture. From there, we work with you to implement a tailored Roof Asset Management (RAM) program to extend the life of your existing assets. Finally, we provide the data and analysis necessary to build a multi-year capital strategy, transitioning your budget from reactive repairs to a predictable, long-range CapEx plan. At RocStout, we provide the engineering, project management, and financial reporting to act as a seamless extension of your asset management team, ensuring your building envelope is a well-managed asset, not an unpredictable liability.