After a storm passes through Bryan, the relief is often short-lived, replaced by a new kind of anxiety: dealing with the insurance claim. The most frustrating and stressful outcome for a homeowner is to do everything right, only to have an adjuster perform a rushed inspection and declare “no damage found.” This leaves you with a compromised roof and the prospect of paying thousands for a problem that should have been covered.

This exact scenario is why RocStout Roofing exists. Our “No Surprises” process is the antidote to the uncertainty of the claims process. It is built on the principle that meticulous, expert documentation is the only way to ensure a fair and accurate outcome. This guide will show you what adjusters often miss and how our process protects you from an unjust denial.

A Professional Inspection: What We Document That Adjusters Often Overlook

An insurance adjuster’s goal is often to close a claim quickly. Our goal is to uncover the complete truth about your roof’s condition. A rushed or incomplete inspection can easily miss critical evidence that is the key to an approved claim. Our systematic process focuses on documenting these commonly overlooked issues:

-

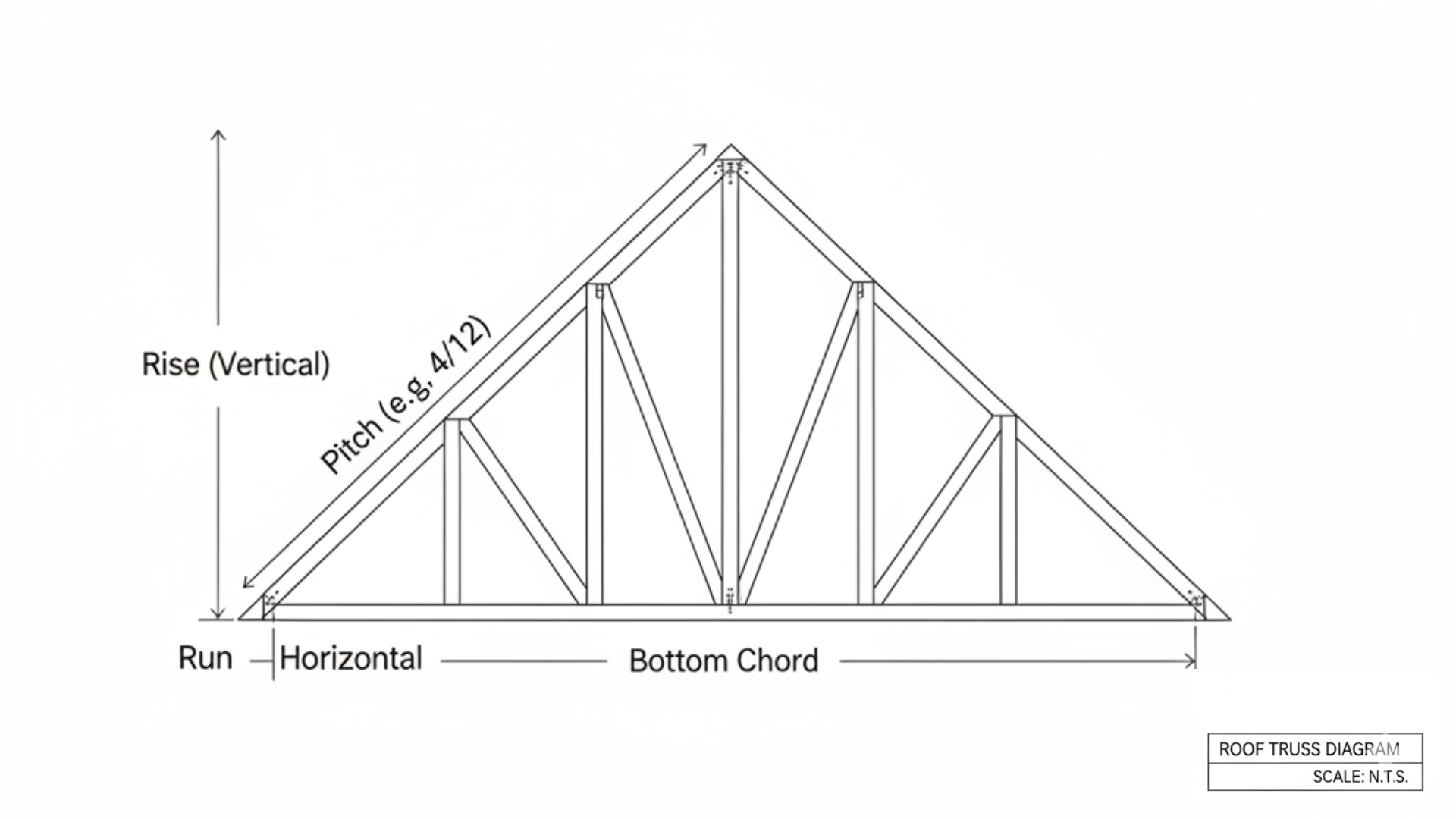

Subtle Hail and Wind Damage: We don’t just look for missing shingles. We get on the roof to identify broken shingle seals, subtle hail “bruises” that weaken the shingle, and the significant granule loss that signals the start of premature aging.

-

Damage to a Multi-Slope Roof: We have seen cases where an adjuster will inspect one accessible section of a roof (like a garage) and ignore steeper or harder-to-reach slopes, leaving significant damage undocumented.

-

Compromised Flashing: The metal strips around chimneys, walls, and vents are critical weak points. We meticulously inspect them for the dents, lifts, and punctures that often lead to a full roof replacement.

-

Underlying Issues: Damage isn’t always visible on the surface. We check attics for signs of moisture and assess the underlying decking to ensure a problem isn’t being hidden by the shingles.

The RocStout Process in Action: How Evidence Changes Outcomes

A denied or undervalued claim is not the end of the story. It is often the beginning of a process where expert evidence becomes non-negotiable. Our involvement has consistently reversed initial denials into fully approved claims.

Case Study: Denied Claim in Rockdale Reversed

After a tornado, an adjuster declared a homeowner’s garage roof a total loss but failed to even get on the main house roof. The claim for the primary roof was denied.

-

Our Process: RocStout performed a complete, on-roof inspection of the entire property, documenting extensive, matching damage on the house.

-

The Result: We submitted our detailed report and photo evidence. The insurance company reversed its decision, and the house roof was fully covered. This is a clear example of how an incomplete inspection leads to an incorrect denial.

Why a Rushed Inspection Puts You at Risk

When an adjuster misses damage, the consequences fall directly on you, the homeowner.

-

Out-of-Pocket Costs: You are left responsible for a roof repair or replacement that should have been covered by your policy.

-

Strict Time Limits: Most insurance policies have a limited window (often one year) to file a claim or dispute a finding. If hidden damage leads to a leak 18 months after the storm, it’s often too late.

-

Future Damage: An overlooked issue today becomes a costly emergency leak tomorrow, potentially causing thousands in interior damage.

The “No Surprises” Path Forward After a Storm

You should not have to be a roofing expert to get a fair assessment. Our process is designed to provide you with certainty and act as your advocate.

-

Always Start with a Professional Inspection: Before you even file a claim, Contact us. Our comprehensive inspection and documentation will become the foundation of your claim.

-

We Meet the Adjuster On-Site: Our representative will be present during the adjuster’s inspection. We walk the roof with them, point out our documented findings, and ensure nothing is overlooked.

-

We Handle the Documentation: We provide the clear, evidence-based reports that are necessary to manage the insurance claims process effectively, including any supplemental claims needed to correct an initial, inaccurate assessment.

Your Shield Against an Unfair Denial

Your insurance policy is a promise to make you whole after a storm. An incomplete inspection breaks that promise. Our process is your assurance that the truth about your roof’s condition will be brought to light through expert, undeniable evidence.